Introduction

Let’s have a quick introduction before moving on to the ACCA Full Form and further on we will discuss more ACCA.

The Association of Chartered Certified Accountants is the ACCA full form or ACCA is a globally recognised certification course with over 200,000 members and 600,000 students from 180+ countries.

Apart from ACCA full form, It is regarded as one of the most prestigious accounting certifications and is highly sought after by students wishing to pursue a successful accounting career.

Because it is one of the most respected qualifications, ACCA is applicable in every country.

The ACCA is a high-level professional qualification based on international accounting and auditing standards that is equivalent to earning a full university degree.

The ACCA course can be taken concurrently with students’ degree programmes such as B. Com, BBA, and so on. It can even be integrated into the degree programme itself.

Because ACCA has a very flexible exam structure, it is an appealing choice for students pursuing or having completed a graduate degree.

ACCA is made up of 13 required exams that must be completed within a maximum of 7 years.

The ACCA qualification encompasses financial statements, management accounting, business taxation and legislation, auditing, and business ethics.

The ACCA syllabus is both industry-relevant and globally accredited, providing students with an excellent opportunity to pursue a career in accounting and finance.

ACCA full form and Eligibility

Aside from the ACCA full form, the ACCA eligibility criteria are also important. Now that you know what the ACCA full form is, here are the eligibility requirements for the ACCA course.

- Students must be 18 years old or older.

- To be eligible for the ACCA course, students must have completed 10+2 as a minimum qualification.

- To be eligible for the ACCA course, students must have a minimum of 65% in Accounts/Mathematics and English, as well as 50% in all other subjects.

ACCA Entrance Exams

ACCA entrance exams are also important apart from ACCA full form. In general, there are no entrance examinations required for ACCA. To award ACCA admissions, some colleges, though, hold entrance exams.

There are two ways to enrol in the ACCA Training, and they are as follows:

- Using a merit-based entrance exam

- Admissions process that is merit-based

The detailed admissions procedure used by institutions like Apeejay Stya University in Gurgaon, which provides merit-based ACCA admissions, is provided below:

1st Step: Complete out the application and submit it: Because some colleges only accept online applications while others accept both, students must complete their application forms online or offline.

2nd Step: Upload documents: After filling out the required sections on the application form, students must scan and send all necessary documents to the admissions portal for admission and verification.

3rd Step: Registration Fee: The application fee, which differs from college to college, must be paid by the applicant. Then, via SMS or email, they will get their registration number.

4th Step: Review of Applications and Shortlisting of Candidates: The university’s admission staff will shortlist candidates after reviewing student applications to determine whether they fulfil the requirements. These students will now be called in order to take part in group discussions and rounds of personal interviews (PI).

5th Step: Group discussions (GD) and individual interviews

Some institutions hold GD and PI rounds to find out more about the candidate’s history and character in light of the standards the university has for its students. Admission Method Depending on Entrance ExamThe detailed admissions procedure used by colleges like Christ University, Bangalore, which provides ACCA admissions based on entrance test, is provided below:

complete and submit the application form.

- Submit the required files.

- Submit the application fee.

- Prepare for the entrance exam in step four.

- The student must register for the entrance test before the deadline if the school to which they have applied does not automatically do so.

- Candidate shortlisting in step five: The institution will select candidates based on the outcomes of the entrance exams. The individuals who made the shortlist will be contacted for extra verification.

- The only applicants called for personal interviews and document verification are those who have made the shortlist in step 5. Candidates who are considered eligible for the course will be admitted.

Have a look at the best PG Program In Investment Banking with PLACEMENT GUARANTEE

ACCA Syllabus

Now, After discussing the ACCA full form, Eligibility and Entrance exam. Let us take a step further and talk about the syllabus. The Syllabus is a crucial part of the course as because a student’s exam will be based on it. It is indeed more important than the ACCA full form, eligibility and exam. The syllabus for ACCA is divided into 13 exams and 3-course levels, which are:

- Knowledge

- Skills

- Professional

The detailed ACCA subjects for each level are given below:

ACCA Subjects: Knowledge Level

- Commercial Bookkeeping or Business Accounting

- Finance Management

- Administration Bookkeeping or Management Accounting

ACCA Subjects: Skills Level

- Commerce and corporate laws

- Taxes and Performance Management

- financial reporting assurance and audit

- Finance Administration

ACCA Subjects: Professional Level

- Strategic Business Leadership

- Strategic Business Reporting

- Advanced Financial Management

- Advanced Performance Management

- Advanced Taxation

- Advanced Audit and Assurance

Candidates must present proof of 36 months of pertinent expertise after passing all 13 ACCA exams. Candidates should also complete the Ethics and Professional Skills Module, which helps candidates build all the skills that employers look for.

Also, Give a visit to the best PG Program In Financial Modelling with PLACEMENT GUARANTEE

ACCA Exams

Following is the list of the ACCA papers, which candidates must clear to earn ACCA certification:

- Taxes, Audit and Assurance (AA) (TX)

- Achievement Administration (PM)

- Financial Management (FM) Financial Records (FR) (FM)

- advanced assurance and auditing (AAA)

- Advancement of Taxes (ATX)

- Higher Level Performance Monitoring (APM)

- Company Strategy Reporting (SBR)

- Contemporary Finance Management (AFM)

- Leader in Strategic Marketing (SBL)

- Advancement of Taxes (ATX)

- Business and Corporate Legislation (LW)

ACCA Top Colleges

Referring back to the ACCA full form, It has got a lot more than just its ACCA full form. The ACCA Training is offered in two formats. First, in conjunction with an MBA or BCom degree, and then separately. The following are the best colleges that provide ACCA courses:

College Names

- Symbiosis College of Arts & Commerce

- Sharda University

- Apeejay Stya University

- Global Centre for Entrepreneurship & Commerce

- Manipal University

ACCA Course Comparison

This part compares the ACCA course to related programmes like CA, CS, and CPA in terms of prerequisites, length, cost, eligibility, admission, and other important elements. There is also a difference between ACCA full form and the others

ACCA full form vs CA ACCA full form

ACCA full form stands for Association of Certified Chartered Accountants. Whereas CA full form stands for Chartered Accountant

A globally recognised certification for accounting education is the ACCA. Similar accounting credentials are offered in India by the ICAI through the Chartered Accountancy (CA) programme. Knowing the differences between ACCA and CA and the ACCA full form and CA full form will help you decide which is the better choice for you.

ACCA (Association of Certified Chartered Accountants)

ACCA full form is Association of Certified Chartered Accountants and it is an accreditation offered by the Association of Certified Chartered Accountants.

- It provides technical knowledge in accounting and finance for high-level managerial positions in the accounting industry.

- Duration of Course 1-7 years

- Course fee INR 65,000 to 2,50,000

- 13 exams in CBE mode

- 10+2 with a minimum of 65% in Accounts/Maths and English, 50% in other subjects

- Merit and entrance based

- Job roles-Accountant, internal auditor, compliance officer, business analyst, risk manager, treasurer, business consultant, chief financial officer (CFO), etc.

- The average Salary is INR 3.5-4 LPA

CA (Chartered Accountant)

The full form is also different from ACCA full form and it mainly focuses on preparing students to work in taxation and auditing firms by educating them on the concepts of accounts and taxation.

- Certifying Agency Institute of Chartered Accountants of India (ICAI) administers CA certification.

- Course Duration 5 years

- Course Fees are INR 20,000 to 2,50,000

- The examination Type consists of 3 exams

- Eligibility is 10+2 with 4 months study period, or

- BCom with minimum 50% marks

- Career Options are Accountants, Auditors, Financial Officers, Finance Managers, Taxation Experts, Investment Advisors, etc

- The average Salary is INR 6-8 LPA

Want to know how to become an investment banker in India?

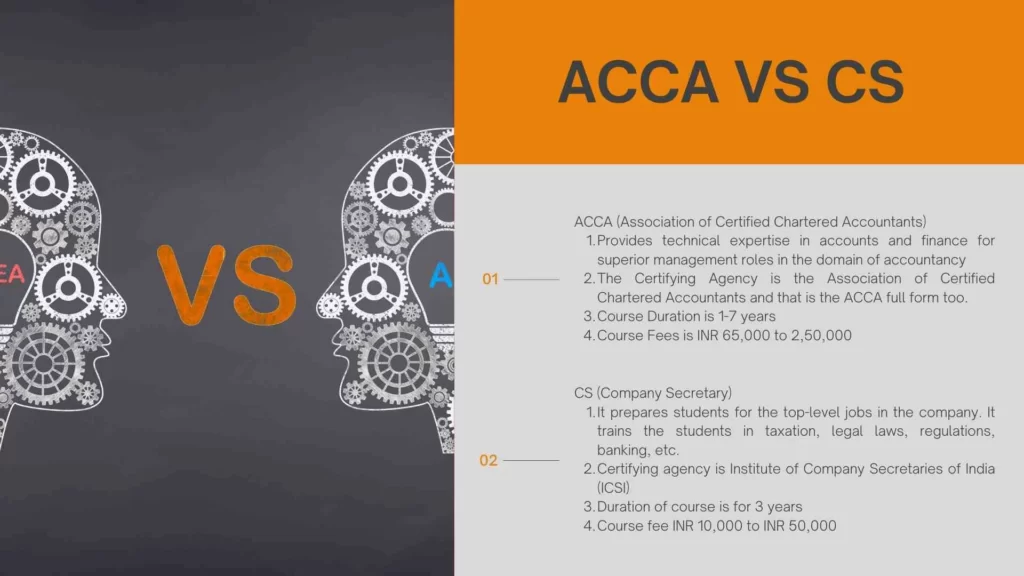

ACCA vs CS

While the ACCA course prepares candidates to be financial officers and accountants, the Company Secretary (CS) course is all about the financial and legal aspects of a corporation. We will also discuss the ACCA full form and CS full form. As you know that the ACCA full form is Association of Certified Chartered Accountants and the CS full form is Company Secretary Given below is the detailed comparison of both courses in terms of qualification, duration, fees, eligibility, admission, and more:

ACCA (Association of Certified Chartered Accountants)

- Provides technical expertise in accounts and finance for superior management roles in the domain of accountancy

- The Certifying Agency is the Association of Certified Chartered Accountants and that is the ACCA full form too.

- Course Duration is 1-7 years

- Course Fees are INR 65,000 to 2,50,000

- 13 exams in CBE mode

- Eligibility is 10+2 with a minimum of 65% in Accounts/Maths and English, 50% in other subjects

- The admission process is Merit and entrance based

- Career Options are Accountant, internal auditor, compliance officer, business analyst, risk manager, treasurer, business consultant, chief financial officer (CFO), etc.

- The average Salary is INR 3.5-4 LPA

CS (Company Secretary)

- It prepares students for top-level jobs in the company. It trains the students in taxation, legal laws, regulations, banking, etc.

- Certifying agency is the Institute of Company Secretaries of India (ICSI)

- The duration of the course is for 3 years

- Course fee INR 10,000 to INR 50,000

- The examination Type consists of 3 exams

- Job roles offered are Company Secretary, Legal Manager, Executive Officer, Director, etc

- Salary ranges between INR 4-8 LPA

ACCA full form vs CPA full form

The difference between ACCA full form and Certified Public Accountants (CPA) course on parameters such as qualification, examination, duration, fees, average salary are discussed below:

ACCA

- Provides technical expertise in accounts and finance for superior management roles in the domain of accountancy

- Certifying Agency is Association of Certified Chartered Accountants

- Course Duration is between 1-7 years

- Course Fees is INR 65,000 to 2,50,000

- Examination Type consists of 13 exams in CBE mode

- Eligibility is 10+2 with minimum 65% in Accounts/Maths and English, 50% in other subjects

- Admission Process is totally Merit and entrance based

- Career Options includes Accountant, internal auditor, compliance officer, business analyst, risk manager, treasurer, business consultant, chief financial officer (CFO), etc.

- Average Salary is between INR 3.5-4 LPA

CPA

Apart from the ACCA full form, It stands for Certified Public Accountants

- Recognized globally to offer numerous opportunities in accountancy.

- Certified authority is American Institute of Certified Public Accountants (AICPA)

- Course duration is One year or less

- Course fee is INR 3,75,000 to 4,00,000

- Total 4 exams in online mode

- Eligibility is MCom or equivalent degree

- Admission is solely Merit based

- Job roles offered are Management accountant, budget analyst, financial analyst, internal auditor, comptroller, professor, VP of Finance, and Chief Financial Officer, etc.

- salary ranges between INR 6.3 LPA

ACCA full form, Scope and Benefits

The demand for ACCA professionals is rising quickly in India as well as worldwide and in India. Like the eagerness to know about the ACCA full form, People are inclined towards this Course

Students with an ACCA qualification can get employment at prestigious firms like Ernst & Young, PricewaterhouseCoopers, KPMG, HSBC, Standard Chartered, and others.

Accounting advisory, risk advisory, corporate finance, audit and assurance, internal audit, taxation, investment advisory, etc. are among the profiles available to ACCA-qualified students in India.

These employment offers are comparable to those for Indian CAs with the same designation, profile, and compensation packages.

Higher Studies after ACCA Course

Students have the option of continuing their education in India or overseas after completing their ACCA course. After ACCA course completion, students can opt for higher studies options like:

Chartered Financial Analyst (CFA USA), a postgraduate degree in finance that is available globally.

The Chartered Institute of Management Accountants (CIMA UK) focuses on accountants who are currently employed in the field and offers training and certification in management accountancy and related fields. It also offers members continuous assistance and training.

Institute and Faculty of Actuaries (IFoA) is the only chartered professional body in the UK dedicated to educating, developing and regulating actuaries based both in the UK and internationally, and is considered by many to be the toughest finance exam in the world.

Financial Risk Management (FRM US), the top certification for risk managers, is sought after by practically every major bank and company in the globe. It is only given to people who can prove they have the skills and knowledge necessary to foresee, address, and adapt to pressing risk situations.

ACCA Careers

ACCA is not just about the ACCA full form but more than that. The ACCA full form is just a name to it but the career scope in it is very much vivid. Students who get an ACCA-qualified chartered account are prepared for senior management roles and can easily climb up to senior positions like Chief Financial Officer (CFO).

The initial ACCA salary can range anywhere between INR 3.5-4 LPA with bright chances of profitable opportunities in the future.

There are as many as 18 job profiles that one can explore after ACCA course, and each profile offers different positions. That said, there are numerous career options in the domain of accountancy.

ACCA Salary

ACCA-qualified professionals are highly sought after by MNCs and the Big 4 because they have deep knowledge of IFRS and global trade regulations.

India is speculated to become one of the biggest markets for ACCA in the upcoming years as there is an increase in global trade and several Multinational corporations who are operating in India require ACCA professionals to move their business accounting procedures according to international standards.

That being said, ACCA-qualified candidates are one of the highest-paid professionals in India and the salary of freshers ranges from INR 400,000 to INR 1,400,000 depending upon the company’s demand and their own skillsets. It goes even higher once they develop relevant skills and expertise through years of work experience. And if you choose VG Learning Destination for ACCA, you can get placed right after your qualification as they offer 100 per cent placement assistance in Big 4 and MNCs.

The current salary packages of the ACCA professionals are similar to the CA but ACCA being a global qualification allows you to work in over 180 countries.

Conclusion

ACCA Full Form is The Association of Chartered Certified Accountants Opportunities for employment with ACCA India have multiplied dramatically in recent years. Jobs for ACCA experts have increased steadily as the number of MNCs and Big 4 firms has increased.

The demand for the certification test has also grown in the industry as more students become aware of ACCA and its advantages.

With such an influx, it is predicted that India could easily become one of the biggest worldwide markets for ACCA. As a result, the Indian economy is moving towards globalization and development. As a result, even MNCs and larger multinational corporations are turning to India to find qualified accountants and top-notch finance specialists.

The pay for ACCA professionals in India is roughly comparable to that of a CA professional. A person with an ACCA degree can make an average income of up to INR 8 lac per year. The pay scale typically falls within the INR 4 lac p.a. level. to Rs 15 lac annually. Depending on the candidate’s qualifications, the needs of the business, the level of rivalry, etc., it might even go higher.

Frequently Asked Questions

The ACCA full form is the Association of Certified Chartered Accountants.

ACCA Exam takes place 4 times a year which are March Session, June Session, September Session and December Session. The ACCA course fee is around INR 170000.

Here’s the good news: no, the ACCA exam is not very difficult. In fact, it is easier to clear the ACCA when compared to other professional finance and accountancy courses like the CA and CFA. It is, of course, tougher than the school and undergraduate tests with which most students are familiar.

If you are moving out of India, ACCA is better valued and Easier in comparison to CA.In India,A CA has Prilevege given by the statute. That makes CA unique. Indian CA is intentionally made Tough Whilst ACCA is not that difficult and stressful. Tough has nothing to Do with knowledge.

With the growth of more and more MNCs and Big 4 companies, there has been a steer rise in jobs for ACCA professionals. Likewise, as more number of students are becoming aware of ACCA and its benefits, the demand for the certification exam has increased in the industry.1

ACCA is a degree that is approved in more than 180 nations and is widely acknowledged. Because the course is specifically designed to meet the requirements of Indian students, CA is only accepted in India. The ACCA programme has been around for more than a century and is respected all over the globe. CA started in 1944 and is only recognised in India.

Therefore, you could finish all of the tests in two years. However, the qualification requires a minimum of three years to finish because you also need three years of practical experience before you can join the ACCA and be deemed a qualified accountant.

The average ACCA salary in India is INR 8 LPA. The ACCA salary is quite similar to the salary of a Chartered Accountant (CA) professional.

Is ACCA higher than CA? As ACCA is globally recognised it is considered above CA. CA deals with India Accounting, finance and taxation systems which makes it great fit for India but not ideal for someone who wants to settle abroad.

Given the number of years, the number of papers, the course levels, and the versatility of both courses, it should come as no wonder that the CA course is frequently regarded as being more difficult than ACCA.