Introduction

Are you considering taking up a CA course? You’ve come to the right place. This post covers everything you need to know about the CA Subjects list and many more details.

The CA course structure is rigorous but rewarding, equipping students with invaluable knowledge and skills in the world of finance. It covers a wide range of topics such as accounting, tax, internal audit, corporate finance, risk management, and more. In addition to these core courses, students may also take up optional courses that align with their professional goals.

The role of a Chartered Accountant is to advise on financial decisions for businesses, individuals and other organizations. They must possess advanced knowledge in different areas of finance and maintain industry standards of excellence and professionalism at all times. With the right qualifications and experience, CA’s can be highly sought after in advisory roles across multiple industries.

Professional opportunities for CA’s are varied and plentiful from public practice to private corporations or even academic positions teaching theory or practical skills related to financial management and audit services. Depending on your strengths and aspirations, you can create your own career path in any number of industries.

In addition to the traditional technical expertise associated with CA studies, candidates require certifications that demonstrate their commitment to attaining professional industry standards set by accounting bodies like CPA Australia or ICAA (Institute of Chartered Accountants Australia). Obtaining relevant certifications will not only boost your expertise but also opens up more job opportunities for you in the field.

We hope this post has given you an insight into what a Chartered Accountant course entails and helped give clarity on some key points like its structure and professional opportunities associated with it.

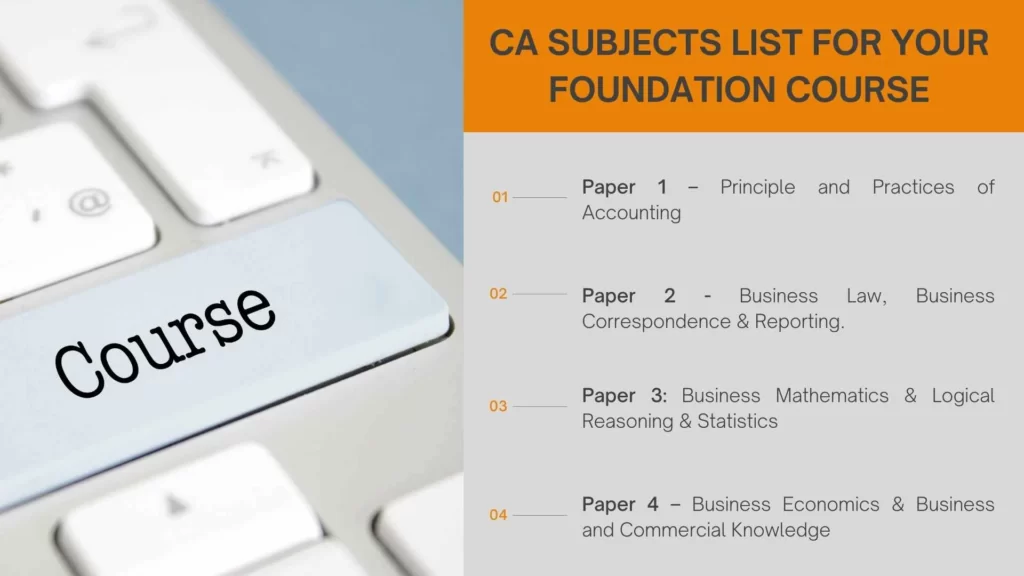

CA Subjects list for your Foundation Course

Are you looking for a comprehensive CA Subjects list for your Foundation Course? Look no further! In this blog post, we’ll cover the two papers that make up the foundation course – Principles and Practice of Accounting and everything about CA Subjects list.

Paper 1 – Principle and Practices of Accounting

It is designed to provide basic accounting knowledge at the foundation level. This paper covers topics such as accounting principles and concepts, double-entry accounting systems, bookkeeping processes and techniques, preparation of financial statements, use of computerized accounting software, management of expenses and debtors, maintenance of stocks and assets, recording inventory transactions and depreciation methods.

At the foundation level, you can expect to learn about various types of business entities, how to calculate GST/VAT and how to interpret financial statements for decision-making purposes. The paper also covers cost definitions, and costing techniques such as job costing & process costing, marginal costing & absorption costing. You will also learn about budgeting techniques & their implications in decision-making as well as ratio analysis & fund flow statement analysis.

It is important to understand the practical aspects of accounting. This paper builds on the foundations laid down in Paper 1 by applying them to practical scenarios. Students learn how to prepare an income statement along with a balance sheet & cash flow statement using computerized accounting software such as Tally or Excel etc. The paper also develops students’ skills in preparing accounts from incomplete records or trial balances.

Paper 2 – Business Law, Business Correspondence & Reporting.

Business Law is primarily focused on understanding the legal aspects of commerce and industry. This subject covers topics like Contracts, the Sales of Goods Act, the Consumer Protection Act, the Negotiable Instruments Act, etc. Further, the business law CA subjects list also examines topics related to company law and industrial law. Additional topics such as Intellectual Property Rights will be also learned in this subject.

Business Correspondence & Reporting focuses on teaching students how to write letters for different scenarios. It covers topics like format for writing official letters, promotional advertisement strategies and writing minutes of meetings. Further, it also teaches fundamentals of report writing which includes drafting an agenda for meeting reports, executive summaries and other details relevant to report writing.

Overall, both papers are essential parts of the training program that all Chartered Accountants have to go through before they can be certified as a professional accountants. Understanding these concepts is key in order to becoming a successful CA and will help you build a successful career in accounting.

Paper 3: Business Mathematics & Logical Reasoning & Statistics

It is an important part of your CA journey. This subject covers theoretical and practical aspects surrounding mathematics, logic and statistics and will provide you with a strong foundation in business intelligence and analytics. With this knowledge, you will be able to make solutions-based decisions that drive business success.

Paper 3 covers topics such as algebra, trigonometry, advanced mathematics, set theory and mensuration as well as logical reasoning & statistics. In particular, you will be studying topics like probability distributions, linear programming and correlation & regression analysis which are all critical concepts within business mathematics and analytics.

In addition to these topics, the paper also covers the basics of Indian taxation laws such as Direct Taxation Laws (Income Tax), Indirect Taxation Laws (Goods & Services Tax), Transfer Pricing and International Taxation; all of which are staples of CA studies and play a crucial role in managing taxes for any corporate entity or individual taxpayer.

By completing Paper 3: Business Mathematics & Logical Reasoning & Statistics in your CA Foundation Course, you will gain an invaluable understanding of fundamental concepts like algebraic equations to advanced analytic techniques essential for making informed solutions-based decisions that effectively drive business performance.

Know about the best investment banking course

Paper 4 –Business Economics & Business and Commercial Knowledge

It is the perfect choice for any aspiring Chartered Accountant. As part of the foundation course, Paper 4 focuses on developing business knowledge and understanding of commercial and legal aspects. You’ll learn about macroeconomic policies and their implications on businesses, microeconomic principles such as elasticity, pricing strategies and consumer behaviour, competition law and consumer protection; as well as additional topics such as international trade policies, corporate governance, financial markets and financial instruments.

This CA subjects list will provide you with an in-depth understanding of financial operations that are essential to managing a business successfully. You’ll also gain valuable insight into industry trends that can help inform key strategic decisions within your organization.

In addition to the theoretical concepts you’ll be taught at the foundation level course, Paper 4 also covers some practical scenarios which will provide you with hands-on experience in further developing your skills in this area. Your acquired knowledge can then be transferred from one business context to another as you progress through your career.

This subject is an essential part of anyone’s journey towards becoming a successful Chartered Accountant – so make sure that it’s included in your CA subjects list!

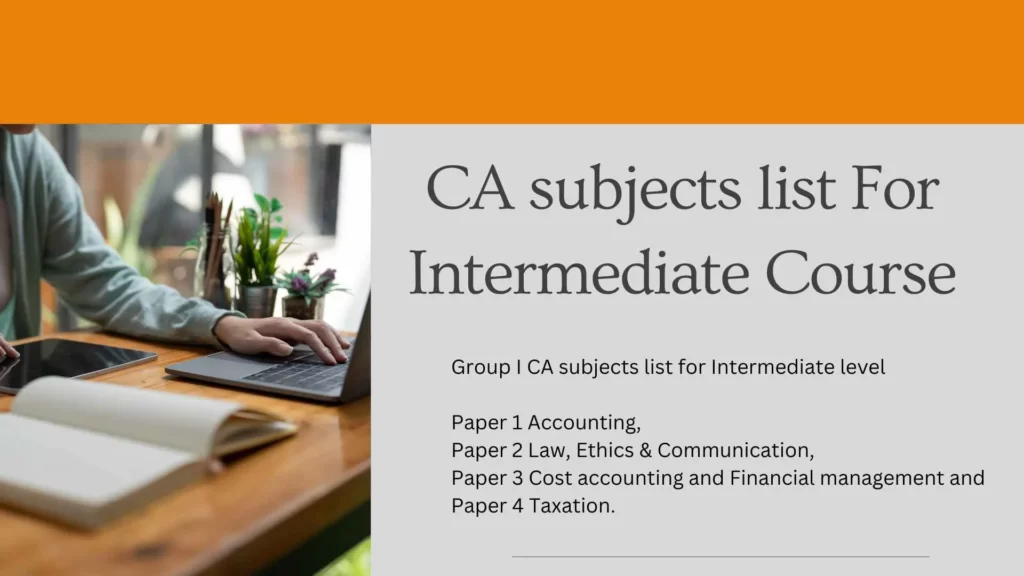

CA subjects list For Intermediate Course

Are you preparing for the Chartered Accountants (CA) Intermediate course? If so, there is an important CA subjects list you need to take for your course. This list will be important for you to refer to as you prepare for this all-important step in your career.

The CA Intermediate course comprises two levels, and each level contains two or more papers. All the papers are divided into Theory and Practical parts with the CA Subjects list. The theory part consists of nine papers while the practical part consists of three papers.

At the Intermediate level, students get to choose between two sets of papers Group I and Group II. Each group has 4 papers and these papers serve as the core topics throughout the entire course body.

Group, I CA subjects list for Intermediate level

Paper 1 Accounting,

Paper 2 Law, Ethics & Communication,

Paper 3 Cost Accounting and Financial Management and

Paper 4 Taxation

Accounting is one of the major areas of interest in this group as it covers a wide range of accountancy topics such as financial statements, bookkeeping systems, accounting standards etc. In addition to this, there are other important topics that are related to managing accounts such as taxation and cost accounting.

Understanding the letters law is also an important aspect covered under this paper which makes sure that all calculations made by accountants adhere to legal regulations. Lastly, communication skills form an integral part of chartered accountancy practice and must be mastered in order to communicate effectively with clients or organizations.

Group II CA subjects list for Intermediate level

Papers 5 Advanced Accounting,

Paper 6 Auditing & Assurance Services

Paper 7– Enterprise Information System & Strategic Management and

Paper 8 – Financial Management & Economics for Finance

Accounting (Paper 1)

This paper covers all the core topics in financial accounting including ledgers, journal entries, introducing accounting standards, inventory valuation and working capital management. It also covers topics such as auditing and assurance, information systems and compliance with international financial reporting standards.

Corporate and Other Laws (Paper 2)

This paper focuses on law related to corporate bodies, banking companies as well as capital market operations. It includes various aspects of contract laws like elements of contract law, sale of goods act, negotiable instruments act, companies act 2013 etc. It also deals with other laws such as securities laws, economic laws IPR etc.

Cost and Management Accounting (Paper 3)

In Paper 3 you’ll learn about cost volume profit analysis, budgeting techniques such as ABC analysis and marginal costing etc., variance analysis using standard costing concepts etc. This paper also deals with topics related to management accounting such as strategic planning tools like SWOT analysis, and QSPM etc., decision-making techniques like sensitivity analysis etc.

Visit one of the best Financial Modelling course

Paper 4 Taxation

Paper four of the intermediate level of CA includes Indirect taxation, International taxation, Wealth Tax, Goods and Services Tax and Transfer pricing. The topics covered in this paper will help you understand the various regulations applicable when it comes to taxes as well as make sure that you are able to assess deductions/exemptions accurately.

Paper 5 Advanced Accounting

This paper deals with topics such as Corporate Restructuring, Global Reporting Standards, Corporate Laws etc. It covers an understanding of financial accounting in some depth, along with other more specialized topics like cost accounting systems and financial analysis techniques. It is important to have a firm understanding of the principles so that you can interpret financial reports correctly and advise businesses on effective ways to manage their finances.

Paper 6 Auditing & Assurance

This paper focuses on auditing and assurance services for companies as well as individuals. The syllabus covers topics such as audit risks and controls, assurance environments, standards for investigations, due diligence evaluations etc. You will be able to apply internal controls for organizations effectively and provide advice on compliance issues or any specific concerns raised by clients or third parties regarding financial matters in accordance with legal regulations.

Paper 7 Enterprise Information System and Strategic Management

It covers topics such as business strategy, business planning, information systems development and implementation, managing technology risks and introducing emerging technologies in an organization. It also focuses heavily on data analysis, database management systems and enterprise resource planning solutions. In short, the knowledge acquired from this paper is vital for a company’s continued operations in an era of technological disruption.

Paper 8 Financial Management and Economics for Finance

It covers economic theory, macro and microeconomics, investment management practices, financial decision-making within organizations and international finance. By getting a sound understanding of economics and finance principles required by a Chartered Accountant during their professional life while working as a Senior Finance Executive or Finance Director in an organization – one can ensure that their client’s business performance is closely monitored and improved in order to survive any competition or changing economic conditions.

Knowing the scope of these papers within the CA subjects list is essential not only to pass the Intermediate Course but also to gain a strong theoretical understanding of accounting fundamentals that are required from a Chartered Accountant. With hard work, dedication and determination it’s possible to overcome this difficult challenge!

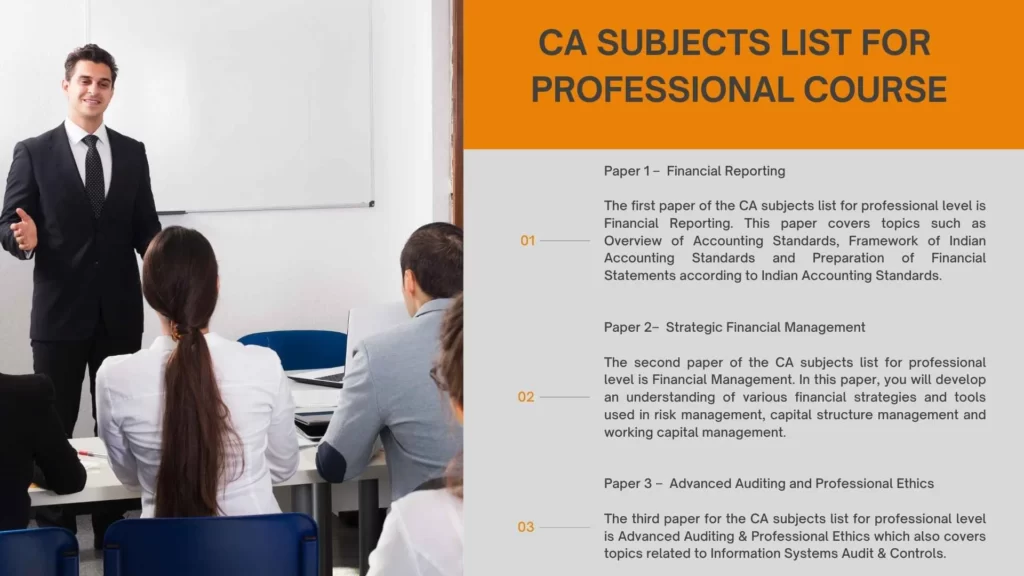

CA subjects list for Professional Course

Are you planning to pursue your Chartered Accountancy (CA) Professional Course? If so, congratulations! The CA subjects list for the Professional course is quite comprehensive, and it will equip you with a vast range of skills and knowledge to help you succeed in your professional life.

Let’s take a look at the CA subjects lists for the Professional course:

Paper 1 Financial Reporting

The first paper on the CA subjects list for the professional level is Financial Reporting. This paper covers topics such as the Overview of Accounting Standards, the Framework of Indian Accounting Standards and the Preparation of Financial Statements according to Indian Accounting Standards. In this paper, you will also learn how to identify and measure various types of revenues and expenses, assess the effects of changing prices on financial statements as well as how recognize and measure an entity’s assets and liabilities.

Paper 2 Strategic Financial Management

The second paper on the CA subjects list for the professional level is Financial Management. In this paper, you will develop an understanding of various financial strategies and tools used in risk management, capital structure management and working capital management. You will also learn about mergers & acquisitions, divestiture & restructuring decisions as well as project appraisal techniques.

Paper 3 Advanced Auditing and Professional Ethics

The third paper for the CA subjects list for the professional level is Advanced Auditing & Professional Ethics which also covers topics related to Information Systems Audit & Controls. You will gain practical tips on assessing internal control systems and carrying out effective audits through this subject. Moreover, you will learn about ethical considerations when conducting auditing services as per the standards of professional ethics laid down by ICAI.

Paper 4 Corporate Laws and Other Economic Laws

The fourth paper of CA subjects list is known as Corporate Laws and Other Economic Laws which teaches you about legal and economic concepts. This paper covers topics such as the Companies Act 2013, SEBI regulations, partnership laws, intellectual property laws and contracts.

Paper 5 Strategic Cost Management and Performance Evaluation

Paper 5 is called Strategic Cost Management and Performance Evaluation which concentrates on corporate management and performance measurement. You’ll learn about business evaluation techniques, cost-benefit analysis, relevant costing concepts, pricing strategies and other related topics.

Paper 6 Elective Paper

Paper 6 is an Elective Paper where you are given the option to write an exam on any subject from four electives provided by the ICAI (Institute of Chartered Accountancy of India). These four electives include Financial Services & Capital Markets, Information Systems Control Audit & Assurance, International Taxation & Advanced Management Accounting respectively.

Paper 7 Direct Tax Laws

Paper 7 deals with Direct Tax Laws where you will gain knowledge on tax administration such as the Income Tax Act 1961, principles of tax deduction at source and other related taxes like wealth tax or fringe benefits tax etc.

Paper 8 Indirect Tax Laws

Lastly, the 8th paper of the CA subjects list for the professional course covers Indirect Tax Laws which teaches you about Excise Law & GST law along with Service Tax Law set by the Indian government.

The knowledge obtained from these eight papers is essential for becoming a successful Chartered Accountant. By understanding the CA subjects list properly, you can prepare yourself well for exams that lead to your certification.

Wanna know how to become investment banker in india

Benefits

The CA subjects list offers a wide range of knowledge-focused topics that are essential for professional success, no matter your career field. Not only does it help build upon your analytical thinking capabilities, but it also provides you with the opportunity to apply these principles to real-world situations.

By understanding the economic and monetary systems involved in various industries, you can gain invaluable insight into the way the world works and apply it specifically to your profession. Moreover, studying from the CA subjects list gives you a great deal of diversity in learning topics, including economics, taxation, business law and strategy, management accounting and more.

What’s more is that by becoming a chartered accountant through a CA qualification course, you open yourself up to many potential career opportunities. Depending on where you graduate from and what type of job roles interest you, you could find yourself working in one of many finance-related functions – such as financial auditing or analysis – or any other type of job related to the accounting discipline.

Finally, being Armed with an educational background based on a CA subjects list can mean big things when it comes to international mobility. Having the ability to confidently explain complex accounting principles while adapting to different financial regulation landscapes will set you apart from other candidates when competing for roles overseas or at multinational corporations worldwide.

The possibilities are endless when studying from the CA subjects list – whether for personal or professional development so make sure that if this is something that interests you then take advantage of all the benefits it has to offer!

Conclusion

The scope of Chartered Accountancy (CA) in India is expansive and covers a variety of disciplines within the accounting and finance field. To become a CA in India, you must go through a rigorous training program that covers a wide range of topics. Lastly, understanding that the CA subjects list comprises three levels: Foundation, Intermediate and Final. Each level has its own set of core subjects that require attention in order to obtain the designation.

- CA subjects list for Foundation Level: Accounting and Auditing Standards, Commercial Laws, Business Economics, Financial Accounting and Reporting, Taxation including Management Accounting and Direct Tax & Indirect Tax Laws.

- CA subjects list for Intermediate Level: Corporate Financial Reporting (Accounting Standards), Cost & Management Accounting (Cost Accounting), Advanced Auditing & Professional Ethics (Auditing), Corporate & Economic Laws (Law), Strategic Financial Management (Finance) – including Investments & Securities Markets.

- CA subjects list for professional level: Direct Taxes [Income Tax], Indirect Taxes [VAT/GST/CST], Advanced Management Accounting – including Risk Management and Strategic Cost Management; Advanced Financial Reporting; Insolvency & Bankruptcy Code (IBC); Information Systems Control & Audit; Global Financial Reporting Standards (IFRS) and International Taxation – Transfer Pricing.

In addition to these core subject areas, many students choose to pursue specialized courses related to their particular field of expertise or interest while studying for the CA exam such as International Taxation or Forensic Audit etc.

Frequently Asked Questions

The 4 CA subjects list is as follows

- Paper-1: Principles and Practice of Accounting

- Paper-2: Business Laws and Business Correspondence and Reporting

- Paper-3: Business Mathematics, Logical Reasoning and Statistics

- Paper-4: Business Economics and Business and Commercial Knowledge

The CA course has three levels under which there are various CA subjects list

- CA Foundation

- CA Intermediate

- CA Final

The Chartered Accountant (CA) course typically takes 4.5 years to complete.

This career path is a great option for commerce students who did not take math in 12th grade, as math is not required to become a Chartered Accountant. To become a Chartered Accountant, you must pass a three-tier exam having different CA Subjects list.

The CA subjects list for Maths Exam is divided into three sections: Business Mathematics (40 marks), Logical Reasoning (20 marks), and Statistics (40 marks).

Maths under the CA subjects list with Commerce makes it easier to pursue Chartered Accountancy than other students, since it is a required subject for CA Foundation. It’s like having icing on the cake!

In India, Chartered Accountancy is a well-respected profession, but the journey to becoming one is not easy. The CA Foundation exam is the first step in this program and is known to be particularly challenging as it requires students to cover the entire syllabus within a limited timeframe.

Auditing is widely acknowledged as the toughest subject in the CA Subjects list. It’s very competitive since it can’t be studied independently; knowledge of Accounting & Corporate Laws and other related laws is necessary to understand Auditing.

The average salary of a Chartered Accountant in India is ₹ 6.5 Lakhs per year. Salaries range from ₹ 2.0 to ₹ 15.0 Lakhs, based on 10,100 salaries received from Chartered Accountants.

Getting a Bachelor of Commerce and Bachelor of Laws (B.Com LLB) is a great choice these days. If you’re sure that’s the route you want to take, you can even combine it with other qualifications such as Chartered Accountancy (CA) or Company Secretaryship (CS).

The Financial Risk Manager (FRM) certification course is also highly sought after and completing it will open up more job opportunities in the finance sector for those who are already Chartered Accountants.