Introduction

Are you considering studying finance? Have you heard about a capstone project in finance but are unsure what it is? A capstone project is an extensive academic research project that requires students to apply their knowledge to a real world situation.

In a finance capstone project, students are required to choose a topic related to current financial theories and practices, conduct extensive research and write a comprehensive report on their findings. Through this process, students are able to develop critical thinking skills and gain experience in navigating the ever-changing world of finance.

When studying finance, students should expect to develop multiple research approaches including qualitative, quantitative and field-based methods. As part of the course requirements, students may also have to demonstrate good writing skills for various components of the capstone project such as discussing key findings from their research or presenting analytical conclusions in the form of graphs and tables. Additionally, students may be required to produce a final presentation or product – such as an investment portfolio strategy or financial plan – as part of their coursework.

Although similar in many respects, there is an important difference between a thesis and a capstone project in finance: the latter does not require formal defence nor does it involve extended data collection or archival research measures. Rather than defending your work through an oral examination, successful completion of the capstone project will depend upon producing a well-crafted written document that displays a synthesized understanding of scholarly literature on your chosen topic.

Completion of your finance capstone project will provide you with invaluable practical knowledge that you can use in any workplace setting as well as potential career opportunities.

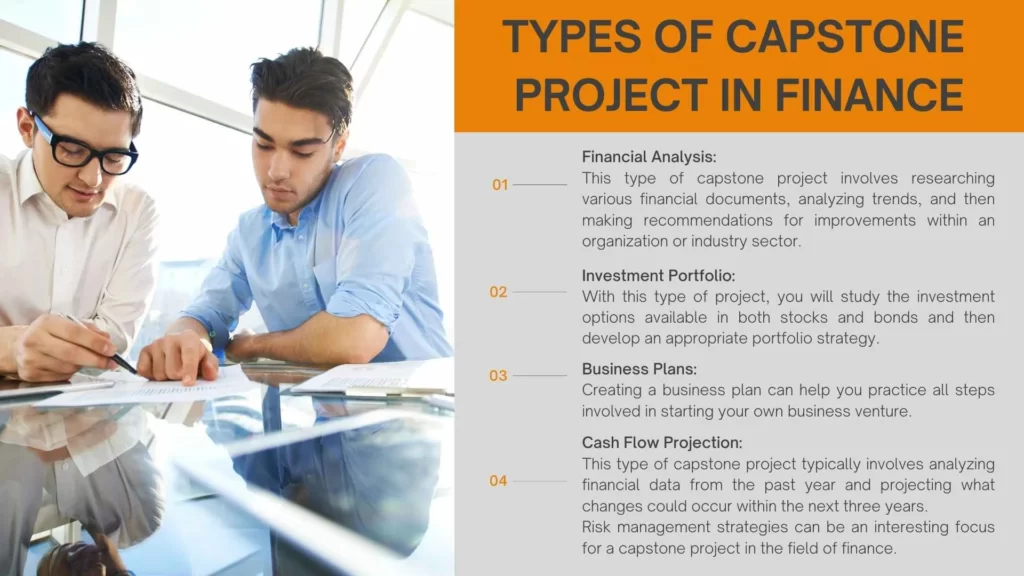

Types of Capstone Project in Finance

The financial world is ever-changing and complex, so it’s essential for finance students to be updated with new concepts and technologies. A great way to combine both theory and practice is to complete a capstone project in finance. A capstone project requires students to explore in depth a particular topic related to finance and create an evidence-based solution or recommendation.

When starting a capstone project in finance, you need to determine which type of project you want to focus on. Here are the most popular types of capstone projects for finance students:

Financial Analysis: This type of capstone project involves researching various financial documents, analyzing trends, and then making recommendations for improvements within an organization or industry sector. You might analyze business performance data from past trends, develop company profiles and financial statements, or evaluate stock market performance.

Investment Portfolio: With this type of project, you will study the investment options available in both stocks and bonds and then develop an appropriate portfolio strategy. You may also help clients create an investment plan suitable to their needs.

Business Plans: Creating a business plan can help you practice all steps involved in starting your own business venture. You will have the chance to develop objectives, strategies, tactics, budgets, cash flow projections, and risk management plans for success.

Cash Flow Projection: This type of capstone project typically involves analyzing financial data from the past year and projecting what changes could occur within the next three years. You may also be required to identify areas that require attention or improvement as part of your final report or presentation.

Risk management strategies can be an interesting focus for a capstone project in the field of finance. You can investigate various risk management approaches and discover which makes the most sense given current market conditions. This type of research is important as it enables individuals and organizations to select the right approach to best protect their financial resources.

Budgeting and forecasting options should also be explored as part of your capstone project in finance. This type of analysis will help you gain an understanding of the current economic landscape and how potential investments may perform over time. It can also provide insight into what markets offer the most return for investors.

Market research activities form another important aspect of a capstone project in finance. You can use this knowledge to inform your decisions when selecting stocks or other types of investments. Through careful analysis, you can confirm that potential investments align with your goals and objectives before taking any action or committing any funds.

Finally, stock exchange simulation is a great way to explore the world of finance without any real financial commitment or risk involved. As part of your capstone project in finance, you can build models that provide insights into trading patterns across different markets. This way, you gain valuable experience into what could potentially happen when investing in stocks or other securities before actually jumping into it with real funds invested.

Have a look at the best PG Program In Investment Banking with PLACEMENT GUARANTEE

Benefits of a Capstone Project

The benefits of a capstone project in finance are vast, and they can help to build fundamental financial literacy as well as industry connections. Working on a capstone project is an excellent way to gain practical experience that sets graduates apart when it comes time to enter the workforce.

A capstone project provides the opportunity for professional networking with experienced financial professionals within your chosen field. This hands-on interaction helps you to understand the financial markets and provide an invaluable glimpse into the working world. Plus, you’ll have the chance to practice research and presentation skills that are essential in any modern workplace.

By taking on a capstone project in finance, you’ll be challenged to creatively solve problems and develop innovative strategies that can be applied to real-world situations. You’ll gain an understanding of economic strategies, investment management, risk analysis and more — all of which are important skills for any successful finance professional. Additionally, having this type of real-life learning experience provides great job prospects should you choose to pursue a career in finance.

In conclusion, a capstone project in finance offers a wealth of knowledge and insight into this challenging field; from developing financial literacy and networking skills to understanding economic policies and gaining practical experience. Your commitment to this type of learning will serve you well now — and even further down the line when it comes time for career advancement or job hunting.

Creating Financial Models for a Capstone Project

Creating a financial model for your capstone project in finance can be a daunting and complex process, but it is essential if you want to ensure the accuracy of your project’s outputs. In this blog, we will discuss some of the key components of creating a financial model to help guide you throughout the entire process.

Financial modelling is the process of creating a structured approach to collecting and analyzing data and then using this data to make informed decisions. This model should include information such as variables, equations, assumptions, and outputs. When creating your financial model for your capstone project in finance, it is important to source reliable and up-to-date data from trusted sources such as published economic reports or major market indexes.

When creating the model for your capstone project in finance, it’s important to consider both inputs and outputs. The inputs are typically constant values that serve as starting points for calculations (i.e. cost of capital), while outputs are assumptions or outcomes that come from changing input values (i.e. net present value). To ensure accuracy when building these models, it is important to perform backtesting by running multiple scenarios with different inputs and measuring their outputs against real-world results.

Additionally, designing an effective project plan when working on your capstone project in finance is essential for ensuring success. Your plan should include steps such as developing hypotheses based on collected data, predicting future outcomes using models created from these hypotheses, testing these predictions against historical trends or current events, validating accuracy with backtesting results, and presenting findings or insights gained through analysis of the model’s output.

Learning the Basics of Investment Portfolio Design

As you embark on a capstone project in finance, one of the most important tasks ahead is to learn how to design an effective investment portfolio. This task requires a knowledge of various investing strategies, asset allocation, and diversification strategies. To help get you started on this critical journey, let’s take a quick look at the basics of portfolio design.

First and foremost, it is important to consider your investment strategy. Are you looking for growth? Income? Both? Or something else entirely? Once you have identified your objective, you can begin to map out an effective asset allocation strategy. This strategy will determine what per cent of your portfolio should be allocated between stocks, bonds and other assets such as real estate and cash equivalents. Make sure to allocate assets in all major categories so that you are properly diversified and have a mix of risk/return investments that suit your particular goals.

Another key element in portfolio design is understanding the risk/return tradeoff; namely that as your level of risk increases, so too does the potential return on your investments. Before taking any risks though it’s important to consider if they are worth taking – in other words, assess whether or not there is sufficient upside potential for making the risky move relative to how much money you stand to lose if it doesn’t pay off. If done correctly, understanding and managing risks can help maximize returns for a given level of risk exposure.

In sum, designing an effective investment portfolio involves careful consideration of certain key elements including investing strategies, asset allocations and diversification strategies as well as understanding the risk/return tradeoff inherent with any investment decision.

Implementing Investment Strategies into a Portfolio

Implementing Investment Strategies into a Portfolio is an important part of any finance capstone project. Knowing how to manage your investments and portfolio can help you achieve the desired return on investment for your financial goals. Before you begin, it’s important to understand the different types of investment strategies and how they affect your portfolio.

Investment Strategies are key to successful portfolio management. Understanding different strategies such as value, growth, or momentum investing can help you determine which ones will work best for your goals. By having a thorough understanding of risk, return expectations, and asset allocation, you can create an effective and lasting portfolio strategy.

Diversification is another important factor when implementing investment strategies into a portfolio. Choosing from different stocks, bonds, mutual funds, ETFs, and other types of investments can help reduce short-term volatility and provide exposure to different asset classes. Additionally, diversification can help minimize potential losses by spreading risk across multiple asset classes or industry sectors.

Prior to investing, it’s also important to evaluate your own risk tolerance and expected return goals so that appropriate investments are chosen for the portfolio. Assessing both short-term and long-term goals will help ensure that capital is successfully allocated in order to meet desired objectives over time.

Once established investments have been made within a portfolio it’s recommended that they be rebalanced periodically in order to ensure exposure remains consistent with original strategies as market conditions change. This may involve selling off certain investments in order to reinvest into others that better align with expectations or goals determined prior to making initial selections.

Finally, tax considerations should never be overlooked when implementing investment strategies into a portfolio.

Understanding Beyond the Fundamentals in Finance

Finance is a field that requires more than just an understanding of the fundamentals. In order to truly succeed and reach your financial goals, a deeper understanding and analysis are needed. With a capstone project in finance, you can develop the skills necessary to understand and utilize all aspects of finance, including financial literacy, analytical thinking, asset management, investment strategies, market trends & insights, and risk management.

Financial literacy is essential for success in any given financial endeavour. Without it, you may not be able to properly read financial documents or know how to plan for long-term goals like retirement planning. You’ll need knowledge of personal money management principles such as budgeting and debt reduction to improve your overall financial well-being. A capstone project in finance will give you the tools needed to build your financial literacy so you can move forward with confidence.

Analytical thinking plays an important role in almost any form of finance. Being able to analyze data thoroughly and effectively is crucial for making informed decisions about investments and other areas of finance. A capstone project in finance will help you hone your analytical skills so that you can interpret information accurately and make sound decisions based on data-driven insights.

Asset management is another important skill that needs mastery when it comes to finance. From properties and stocks to mutual funds and foreign currencies being able to manage different types of assets successfully is essential for reaching your long-term goals. A capstone project in finance can help you build a comprehensive understanding of asset management techniques that are tailored specifically around your own individual circumstances.

Investment Strategies: When it comes to investing for your capstone project in finance, there are a variety of investment strategies available. From index investing to value investing and everything in between, understanding each strategy’s potential return on investment (ROI) as well as its associated risks is an important first step towards making an informed decision.

Market Trends & Insights: Analyzing market trends can provide investors with invaluable insight into the direction that their investments might take. Understanding current events and global economic conditions can often help you decide which stocks or assets may perform better than others in a given economic climate or period of time. Aspiring investors should familiarize themselves with industry news sources, market indices, and other tools that can provide investors with data-driven predictions.

Risk Management: Risk management is essential when investing. While higher risks investments often yield higher returns, they also pose greater risks of principal loss. Mitigating these risks through diversification across asset classes or by working closely with experienced advisors is critical to protecting your investments over time.

In conclusion, understanding beyond the fundamentals of finance is essential for success in a capstone project in finance. Investors must understand different investment strategies, learn how to analyze market trends and insights correctly and employ risk management techniques to make informed decisions about their investments. By doing this work prior to making any investment decisions you will put yourself on a path towards financial success!

Opportunities in Finance Through a Capstone Project

A capstone project is a culminating activity that involves students completing a research project that demonstrates their knowledge and skills. It’s an excellent way to showcase your strengths and abilities, while also learning more about the numerous opportunities available in finance.

A capstone project in finance typically involves researching and projecting potential outcomes for different financial investments. Students will work with real-world scenarios such as creating business plans, managing budgeting issues, investing, international banking, stock analysis, forecasting and working with derivative trading instruments. By analyzing these topics, students gain an understanding of how to take risks appropriately along with evaluating current investment performance.

The primary benefit of completing a capstone project in finance is the ability to develop critical thinking skills around complex financial decisions. Through this project, you can acquire valuable experience that will help prepare you for further study or successful career paths in the field of finance such as banking or investments. You will also be able to use your coursework and practical experience to develop a strong resume that reflects your dedication to financial excellence.

In addition to these advantages, completing a capstone project in finance provides great networking opportunities thanks to contacts that can be made through interviews with professionals or industry specialists. Many instructors allow students access to key players within their respective industries so they can learn more about the field before taking on larger roles within it after graduation.

This can be invaluable insight when constructing potential portfolios or conducting research on markets and investments. By utilizing all the resources provided by completing a capstone project in finance, you can gain immense knowledge

Scope of capstone project in finance

When it comes to capstone projects in finance, there is a lot of work that goes into the research and analysis. In order to create a successful project, you need to have a comprehensive understanding of the field, including market trends and predictions, risk management strategies, international financial policies, and current developments in finance. This means that extensive research is required before beginning a capstone project in finance.

Once this research is completed, you will be able to begin the comprehensive analysis of the results. This includes delving deeper into market trends and predictions to accurately assess how they will affect the project outcomes. Additionally, you must understand risk management strategies and international financial policies to help ensure that your project meets all necessary standards and regulations.

In addition to understanding market trends, international policies, and risk management strategies, it is also important for you to understand the impact of technology on the finance sector. With new advancements in financial technology coming out every day, it is important for capstone projects in finance to take these changes into account when crafting solutions.

This includes understanding how this new technology can be used as part of an investment portfolio performance strategy or how blockchain can revolutionize banking services.

Conclusion

Finally, one of the most important aspects of a successful capstone project in finance is staying updated with current developments in the industry. By regularly reading industry news and analyzing financial reports from around the globe, you can gain insight into areas such as macroeconomics and government policies that directly influence your project outcomes.

By having an updated view on these topics, you can make informed decisions about your project which are more likely to produce positive results.

Frequently Asked Questions

Creating a public service announcement to be shown on public television, and designing and making a product, computer program, app or robot to help people with disabilities.

The term “capstone” comes from the last stone placed on top of a building or monument. It has been used in higher education in the United States since around the 1950s, but it is believed to have been used as early as the late 1800s.

A capstone project is when someone identifies a problem in the real world and uses what they have learned to create a solution.

The capstone project is your chance to work together as a team to come up with an original solution to a real problem. It may be tough, but it’s also very fulfilling.

Both a capstone project and a thesis are scholarly efforts of high quality. A capstone project focuses on preparing the student for professional practice, while a thesis is an academic-focused research project with wider implications.

Capstone and thesis are often used interchangeably, but they involve different types of work and have distinct differences. A capstone is usually part of an undergraduate program, while a thesis is typically done at the end of a graduate program.

A capstone is a final assignment designed to show what you have learned through your studies. It may be called a culmination project, senior thesis, or final exhibition. The form of the capstone will depend on your major.

A capstone paper is typically 25 pages, while a thesis can be much longer (up to 100 pages or more). It’s a more demanding type of research paper. If an undergraduate student wants to pursue a doctoral degree, the capstone project can help them prepare for writing their thesis.

Possible alternatives include “summit”, “top”, “crowning point”, “acme”, “apex” and “apogee”.

If you’re writing a capstone paper or project, here are the steps you should follow:

- Choose a subject to focus on

- Read up on existing research related to your topic

- Gather data and information through your own research

- Present your findings in the paper or project