Introduction

Credit analysis is an important process in the world of finance, where it is used to assess the likelihood of a borrower’s ability to repay a loan. It involves examining an individual’s creditworthiness, which includes looking into their income and debt levels, their payment history, and the capacity of their collateral. By analyzing these factors, lenders are able to determine whether or not an individual is trustworthy enough to provide a loan.

When you apply for a loan or financial product, your credit analysis is essential to determine if you qualify for that specific product. Your credit report will be reviewed closely and if the lender finds any red flags in your profile, it could prevent you from qualifying for that particular product. This can range from having too much credit card debt or too many accounts on your report that were paid off late.

The other components of credit analysis are income assessment and collateral capabilities. The lender may look at your current income levels to determine if you are able to make timely payments on a loan. Then they may evaluate the value of any collateral that you have indicated that you plan to use as security for the loan — such as property or vehicles — in order to determine your ability to pay back the loan should it go into default.

In conclusion, understanding what goes into your credit analysis report is critical when applying for any kind of loan or financial product. The lender uses this information to make sure that you’re financially responsible enough before approving a loan amount. So understanding how lenders work and improving your financial standing along with regularly checking your credit score every so often help ensure smooth sailing through the loan application process!

Components of Credit Analysis

Credit analysis is the process of evaluating a potential borrower’s ability to repay a debt. This evaluation is essential in order to reduce the risk of default and identify suitable borrowers. When performing credit analysis, lenders consider several components that help them determine whether to approve or deny a loan.

Credit scoring is one of the first components in credit analysis and generally involves calculating a score based on an individual’s history of borrowing money. This score helps lenders determine a borrower’s trustworthiness and financial responsibility by providing insight into how prompt they are with making their payments on time and how much debt they have previously taken on.

Another important component of credit analysis is financial statement review. Lenders want to ensure that all information provided by the borrower is accurate and up-to-date, as well as assess their current financial health (assets, liabilities, net worth). By reviewing income statements, balance sheets and other financial documents, lenders can get an overall view of the borrower’s current financial situation and make an informed decision regarding the loan application.

Risk assessment is also considered in credit analysis – this includes assessing the potential risks associated with issuing a loan to a particular customer or business entity. Risk assessment factors may include the applicant’s industry experience, past performance on other loans, customer profile data or external market conditions.

In addition to these components, lenders will often perform collateral evaluation and cash flow analysis when evaluating loan applications. Collateral evaluation involves assessing what assets can be used to secure the loan should repayment not occur as agreed upon by both parties involved (such as property or vehicles). Cash flow analysis involves looking at historical cash flow data from both income statements and balance sheets in order to determine whether an applicant has sufficient cash reserves.

Give a visit to the best PG Program In Financial Modelling

How Does Credit Analysis Function

Credit analysis is an important tool for lenders when assessing risk and determining whether to grant a loan. It involves a thorough review of the borrower’s creditworthiness and repayment capabilities, as well as evaluating other aspects of the loan. This blog post will explain how credit analysis functions and provide insight into the steps involved.

The first step in credit analysis is assessing the borrower’s creditworthiness. This requires obtaining data on the history and background of the borrower, including details about their income, assets, debt, and any other liabilities. The lender will also need to establish collateral value and analyze repayment capabilities, such as cash flow projections or other documents that can help them determine how responsible the borrower is with managing their financial responsibilities.

Another key aspect of credit analysis is evaluating commitment from both parties to the transaction. This means looking at factors such as existing contracts, accounts receivable and payable, past borrowing history, and any guarantees or commitments made by either party. The purpose of this evaluation is to gain an understanding of how invested each party is in making sure they stay on track with payment terms agreed upon in the loan agreement.

Once all these assessments have been completed, the lender will be able to make a recommendation on whether they should grant or deny the loan based on their findings. During this step, they will consider any risks and benefits associated with granting such a loan as well as set conditions that must be met before proceeding further with the approval process.

Ultimately, credit analysis helps lenders make informed decisions about granting loans by giving them an in-depth look into an applicant’s ability to repay a loan based on their financial history and stability. By following these steps lenders can better protect themselves from potential losses caused

Types of Ratios

Undertaking credit analysis can help you understand a company’s liquidity, debt levels, and overall financial health. One of the most important elements of credit analysis is analyzing ratios. Ratios provide meaningful insight into a company’s performance, and when used in combination with other metrics can inform decisions regarding the soundness of an organization.

Efficiency ratios are used to measure how well a company is able to manage their assets and liabilities. These ratios include measures such as asset turnover, receivable turnover, and inventory turnover. For example, if the asset turnover ratio is high it may indicate that the company is making effective use of its resources while if it is low it may point to inefficient use of assets which could lead to cash flow issues.

Profitability ratios are also an important part of credit analysis. These ratios can tell you how much profit a company generates relative to its sales or assets. Ratios such as return on assets (ROA), return on equity (ROE), gross margin, and operating margin are all examples of profitability ratios that measure the company’s performance over time. A low ROA may indicate that the business isn’t performing well while a high ROE might suggest high returns on shareholder investments.

In order to accurately assess a company’s financial health, credit analysis should always be done with both efficiency and profitability ratios in mind. By closely examining these two types of metrics you can get an accurate sense of how well an organization is managing its resources and whether or not it is utilizing its profits effectively. When assessing companies for potential investments or partnerships, taking into account their efficiency and profitability ratios can help ensure that you make sound decisions regarding their financial health.

Also visit:- best PG Program In Investment Banking

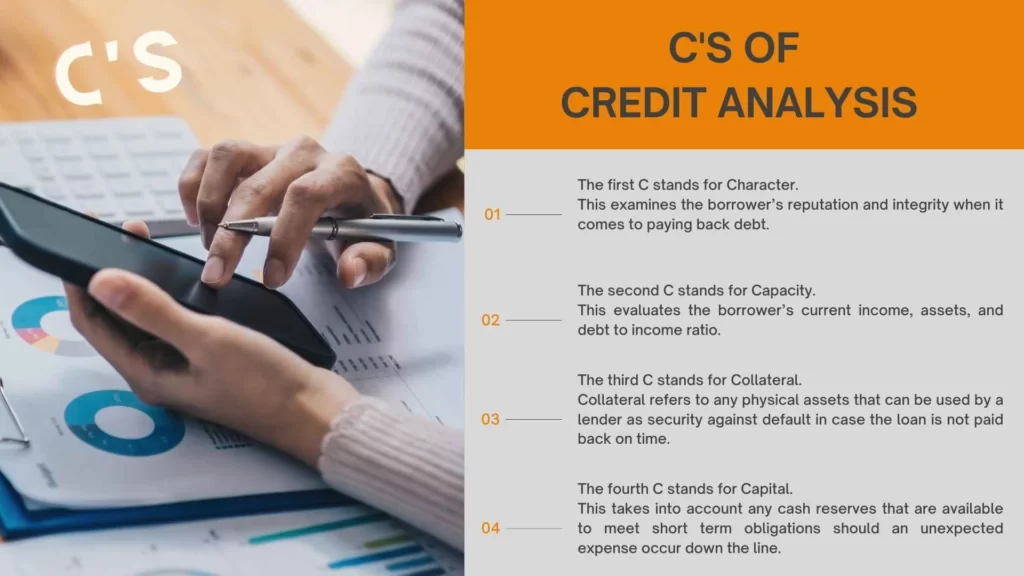

5 C’s of credit analysis

Understanding the 5 C’s of credit analysis is an essential piece of knowledge for those looking to assess creditworthiness and make informed financial decisions. To accurately evaluate a potential borrower’s ability to repay, it’s important to understand each C of the analysis process.

- The first C stands for Character: This examines the borrower’s reputation and integrity when it comes to paying back debt. A thorough background check can determine how reliable the borrower will be in terms of meeting repayment deadlines, as well as uncover any history of bad behaviour or irresponsibility with money.

- The second C stands for Capacity: This evaluates the borrower’s current income, assets, and debt-to-income ratio. Capacity helps lenders understand whether a potential borrower has enough money to cover the mortgage payments needed to buy a home.

- The third C stands for Collateral. Collateral refers to any physical assets that can be used by a lender as security against default in case the loan is not paid back on time. Collateral may include real estate, valuable items such as jewellery or artwork, stocks or bonds, and savings accounts.

- The fourth C stands for Capital: This takes into account any cash reserves that are available to meet short-term obligations should an unexpected expense occur down the line. Capital helps us judge how likely it is that a potential borrower will be able to pay off their debts even in difficult times—especially if they don’t have collateral assets available to fall back on if need be.

- Finally, there’s Capital capital includes assets such as savings accounts, stocks and bonds, retirement funds, real estate investments, and other liquid assets.

Understanding Credit Risk

Understanding credit risk is a critical skill for any financial institution. A thorough assessment of a borrower’s creditworthiness, along with an analysis of their risk profile, is essential for making informed decisions about extending loans. But how can you ensure that you’re doing it right?

To begin with, it’s important to assess the borrower’s financial statements and analyze their repayment history. This will give you insight into their ability to pay back the loan in a timely manner. Additionally, examining the strength of their collateral assets, such as real estate or securities, can further inform your decision-making process.

Once you’ve done your assessment of a borrower’s financial standing and creditworthiness, you need to analyze the associated risk level. To do this effectively, you should estimate the default probability based on historical data. This requires carefully tracking previous loan payments and understanding trends in defaults within a given sector or demographic group. It also helps to review any past bankruptcies or judgments before making a final determination about granting a loan.

In assessing credit risks, it’s important to consider all available information about a potential borrower before making any decisions. By thoroughly analyzing their financial statements and repayment history, estimating default probabilities based on historical data and understanding any associated risks, you can make more informed financial decisions and better manage credit risks for your organization.

Also, Look at the famous investment banking courses

Why is it Important

Credit analysis is an invaluable tool for lenders and borrowers alike. It provides lenders with a comprehensive understanding of an individual or entity’s credit profile, allowing them to assess the level of risk associated with a particular loan. For borrowers, it offers insight into their personal finances and creditworthiness, as well as the opportunity to make necessary changes in order to qualify for future loans.

For lenders, performing a credit analysis helps ensure that they are taking on minimal risk when considering a potential borrower. By looking at factors such as credit history, debt-to-income ratio, and collateral value, lenders will be able to determine whether or not the applicant meets their lending criteria. Armed with this data, they can make better-informed decisions on how much money to lend out and at what interest rate. This helps reduce the risk associated with any given loan and keeps lenders protected from default payments.

For borrowers, credit analysis also provides an important service. By getting an overview of their personal finances, borrowers can identify areas where improvements need to be made in order to increase their chances of being approved for additional loans in the future. This could include building up their credit score by paying bills on time, reducing the total amount of debt they have outstanding or saving more money for larger down payments in order to qualify for lower interest rates. All these efforts can help improve one’s overall financial health and even save them money over time.

In summary, credit analysis is essential for both lenders and borrowers alike because it provides each party with vital information that would otherwise remain hidden from view without it.

Analyzing Financial Information and Reports

Analyzing financial information and reports is a key skill that every credit analyst should possess. It’s important to understand the financial information and how it relates to your specific industry – this helps you make informed decisions on credit offerings. You also want to familiarize yourself with industry benchmarks and trends in order to stay competitive.

When analyzing a company’s financials, begin by gathering the necessary financial information. This includes all of the company’s income statements, balance sheets, cash flow statements and other related documents. A thorough analysis requires you to look at both short-term performances as well as long-term trends.

Once you have gathered all of the reports, start by looking for discrepancies and any pieces that don’t appear consistent with each other. Analyze each report individually, making sure all calculations are correct and accurate. From there, look for any telltale signs of fraud or mismanagement – such as inconsistencies between numbers reported for different periods or unexpected changes in spending habits or revenue sources.

After evaluating the accuracy of the documents, compare the company’s performance to industry standards for similar companies over both short-term and long-term periods. Doing so allows you to accurately assess how risky an investment might be in relation to others in its sector or region. This also provides a way to benchmark against competitors so you know where your business stands relative to them and can make better decisions about credit offerings accordingly.

Common Challenges in Credit Analysis

Credit analysis is critical for assessing creditworthiness, managing risk, and making informed lending decisions. It requires a thorough understanding of the borrower’s ability to pay back loans, as well as their financial history and profile. However, this process can be challenging for financial institutions due to the variety of tasks associated with credit analysis. Here we will explore some of the most common challenges in credit analysis.

Risk Assessment – Risk assessment is an important step in credit analysis. It involves analyzing the borrower’s personal and business finances, as well as their background information to assess their ability to pay back a loan. The difficulty lies in accurately quantifying this risk and determining the appropriate level of protection against default or delinquency.

Financial Statement Analysis – Financial statement analysis is an integral part of credit analysis as it helps lenders determine the borrower’s ability to pay back a loan. Financial statements help lenders assess creditworthiness based on past performance and provide greater insight into the borrower’s potential repayment capabilities.

Credit Scoring Systems – Credit scoring systems are automated models used by lenders to evaluate potential borrowers and assess their level of risk. These systems are beneficial because they provide more accurate results than manual methods; however, they can be difficult to set up properly due to the complexity of the input data required for scoring.

Data Gathering & Interpretation – Data gathering and interpretation are crucial components of credit analysis. During this process, lenders must gather all pertinent information about the borrower such as assets, liabilities, income statements, balance sheets, etc., so that they can accurately evaluate their financial position before making a decision about whether or not to extend a loan. Once collected, this data must then be interpreted in order to make

Career Role In credit analysis

A career in credit analysis is an exciting and important position in the financial industry. As a credit analyst, you will be responsible for analyzing the creditworthiness of potential borrowers and providing loan decisions based on comprehensive assessments.

In order to properly analyze a borrower, professionals in this field must understand the role of credit metrics in evaluating financial stability. These metrics include a review of past performance and current liquidity, as well as consideration of repayment history and debt/equity ratios. Once these factors are evaluated, further documentation review may be necessary to ensure the accuracy of the assessment.

In some cases, you may need to conduct financial modelling in order to project potential scenarios and gain a better understanding of potential risks or returns associated with certain loans. This type of analysis requires critical thinking skills and an eye for detail to appropriately factor in various variables.

Once the necessary analysis is completed, it is time to make a loan decision. As a credit analyst, it is your job to weigh all factors that have been evaluated while assessing the overall risk associated with a particular loan over its lifetime, helping organizations determine suitable applicants who can bring them future profitability while minimizing their risk exposure as much as possible.

Overall, a career in credit analysis requires knowledge, precision and dedication to properly evaluate borrowers and ultimately make sound decisions regarding loan applications. The reward for such responsibility is great; you will not only be playing a vital role in protecting organizations from risk but advancing their growth opportunities through smart lending practices.

Conclusion

Credit analysis is a field of study that has become increasingly important as the economy of India grows and evolves. Credit analysis is a statistical process used to assess an individual or company’s ability to repay their debts in a timely manner. It measures their past performance, current financial condition, and creditworthiness. The scope of credit analysis in India is broad, encompassing factors such as economic conditions, the type of business involved, corporate developments and political stability.

When evaluating someone’s creditworthiness, credit analysts look at the person or organization’s level of debt compared to its income and assets. They also consider the applicant’s payment history, risk factors, and other factors that could affect their ability to pay back loans. Credit analysts are responsible for making recommendations about whether or not a loan should be approved based on this information.

In India, credit analysis plays an essential role in the banking industry because it helps banks make well-informed decisions while lending money to individuals or companies. It allows them to evaluate if the borrower is likely to be able to meet their repayment obligations and thus provides peace of mind when providing loans.

Furthermore, accurate credit analysis ensures that banks adhere to regulations set by the Reserve Bank of India (RBI) while making lending decisions. In addition to providing banking institutions with insight into a customer’s ability to pay back borrowed funds, credit analysis also provides valuable information regarding potential investments for businesses or investors looking for new opportunities in India. By evaluating the financial health of companies or businesses seeking funding and analyzing their risk profile against industry benchmarks, investors can make well-informed decisions about their investments.

Frequently Asked Questions

Credit analysis is governed by the “5 Cs of credit:” character, capacity, condition, capital and collateral.

The Four Cs (Capacity, Collateral, Covenants, and Character) of Credit Analysis.

The credit analysis process comprises various techniques, namely cash flow analysis, trend analysis, risk analysis, ratio analysis, etc. All these analyses are done to determine the risk associated with investing and the amount of loss the lender can suffer.

A traditional credit analysis requires a strict procedure that involves three key steps: obtaining information, a detailed study of this data and decision-making.

Principle of Productivity, Principle of Phased disbursement, Principle of Proper utilization and Principle of repayment.

The 7Cs credit appraisal model: character, capacity, collateral, contribution, control, condition and common sense has elements that comprehensively cover the entire areas that affect risk assessment and credit evaluation. Research/study on non-performing advances is not a new phenomenon.

Bottom Line Up Front. When you apply for a business loan, consider the 5 Cs that lenders look for Capacity, Capital, Collateral, Conditions and Character. The most important is capacity, which is your ability to repay the loan.

Standards may differ from lender to lender, but there are four core components — the four C’s — that lenders will evaluate in determining whether they will make a loan: capacity, capital, collateral and credit.

The three types of Credit Analysis are

Liquidity ratios – These ratios deal with the ability of the company to repay its creditors, expenses, etc.

Solvability ratios – These ratios deal with the balance sheet items.

Solvency ratios – Solvency ratios are used to judge the risk involved in the business.

Credit analysis seeks to provide a fundamental view of a company’s financial ability to repay its obligations. While factors such as operating margins, fixed expenses, overhead burdens, and cash flows might be the same in equity and credit analyses, the emphasis is different for each.