Overview

An accountant salary in Dubai is quite impressive because of the demand of the accountant in Dubai and also CPA Dubai certification is a valuable asset that opens the door to a wide variety of bookkeeping career paths. For example, those with this certification can specialize in areas such as Guarantee Services, Forensic Audit, International Bookkeeping, Internal & External Auditing, Tax & Financial Planning, Consulting Providers, and Forensic Accounting. Having this certification can not only help you find work in these industries in Dubai but also abroad.

In this article we will explore what CPA Dubai means and how you can become a certified public accountant (CPA) in Dubai. To become a CPA in Dubai, one must complete a rigorous educational program combined with practical experience and pass the required exams set by ICAEW. This process requires dedication and hard work but the rewards are well worth it. It is an invaluable tool for finding employment opportunities or starting your own business in the lucrative field of accounting.

Distribution of accountant salary in Dubai

An accountant salary in Dubai is quite varied, with a minimum monthly salary of 6,440 AED and a maximum of 21,100 AED. The median accountant salary in Dubai is 14,000 AED per month, representing the midpoint where half of all workers make more than that amount and half make less.

Looking at the percentile breakdown of accountant salary in Dubai provides further information into the range of salaries for this profession. The 25th percentile is 9,180 AED per month, meaning that 25% of Accountants are earning less than this amount. At the 75th percentile, 18,200 AED per month is earned by 75% of Accountants; conversely 25% are earning more than this figure.

The salaries range from 6,440 to 21,100 AED with the median salary being 14,000 and percentiles at 9,180 and 18,200 respectively.

Comparison of accountant salary in Dubai by Years of Experience

An accountant salary in Dubai with less than two years of experience can expect to earn an average of 7,540 AED per month. This figure is based on statistics compiled by reputable sources such as the World Bank and the UAE Ministry of Labour, which show an average salary of 7,540 AED for entry-level accountants in the United Arab Emirates. Of course, this salary may differ depending on a variety of factors such as education level and job location. Additionally, experienced accountants typically earn more than their entry-level counterparts, often earning upwards of 10,000 AED per month.

The accountant salary in Dubai between two and five years of experience is considerably higher than someone with less than two year’s experience. In particular, they can expect to earn 10,700 AED per month which is a 42% increase in salary. This demonstrates the value that additional experience can bring to a potential employer and reflects the premium that is placed on those who have been in the industry for a longer period of time.

As the years of experience increase, so does the accountant salary in Dubai. For example, those between five and ten years of experience earn 14,000 AED per month—a staggering 31% more than someone with two to five years of experience. This significant jump in salary is a testament to the value employers place on knowledge and experience in the workplace.

An accountant salary in Dubai with more than ten years of experience typically receives a salary that is significantly higher than those with five to ten years of experience. Specifically, they can expect to receive an average salary equivalent to 17,300 AED per month, which is 23% greater than the amount earned by someone who has been working in the accounting profession for between five and ten years.

If the experience is of 15-20 years, then an accountant salary in Dubai is 18,400 AED per month – 6% higher than those with ten to fifteen years of experience. This difference of an accountant salary in Dubai reflects the increased expertise, knowledge and skill associated with a higher level of experience in a particular field. With fifteen to twenty years of experience, an individual can be expected to have a greater understanding of their role as well as the industry they are in. Consequently, employers are willing to pay a premium for this level of experience and proficiency.

An accountant salary in Dubai with more than twenty years of professional experience is rewarded in the form of a higher salary, fetching them 20,100 AED per month – 10% more than those with fifteen to twenty years of experience. This is an acknowledgment for their dedication and commitment over the years, ensuring that their hard work and expertise is appreciated and rewarded. This additional remuneration serves as an added incentive for employees to stay in their positions for a longer period of time and continue to contribute to the success of the organization.

Comparison of an accountant salary in Dubai by Qualification

It’s no secret that the more education you have, the better your salary will be – but just how much of an advantage does a degree give you? To answer this question, we conducted a study to compare the accountant salary in Dubai based on education level. We found that an accountant salary in Dubai with higher levels of education generally earned substantially higher incomes than those with lower levels of education.

More specifically, An accountant salary in Dubai who held Bachelor’s degrees in Accounting earned an average salary of $62,000 per year, while those with Master’s degrees had an even higher average salary of $75,000. For comparison, those holding only a high school diploma earned an average annual salary of $42,000. This data suggests that the more educated you are in a specific field such as Accounting, the more money you can make as a result.

The average accountant salary in Dubai when their highest level of education is High School is 9,370 AED per month. This figure is a reflection of the general market rate for individuals with no further qualifications after completing their high school education and entering the job market. The amount reflects an individual’s skill set and knowledge base, as well as the current demand in the job market for Accountants with a high school diploma. Additionally, this salary may vary depending on factors such as location and experience, which could affect both the supply and demand of Accountants with a high school degree.

The accountant salary in Dubai of someone with a Certificate or Diploma is approximately 16% higher than that of someone with only a High School degree. Specifically, individuals with a Certificate or Diploma can expect to earn 10,800 AED per month on average, while those with just a High School degree tend to receive around 9,300 AED per month. This difference in pay reflects the greater level of knowledge and expertise typically associated with higher levels of education.

While an accountant salary in Dubai who holds a Bachelor’s Degree typically earn an average salary of 15,800 AED per month – an impressive 46% more than those with only a Certificate or Diploma. This is due to the fact that bachelors’ degrees provide recipients with a more advanced level of education, allowing them to qualify for higher-paying jobs and positions that require more specialized knowledge and skills. The additional earning potential associated with obtaining a Bachelor’s Degree makes it a desirable option for many professionals who want to increase their earning potential and career opportunities.

Professionals who have achieved a Master’s Degree generally enjoy an average monthly salary of 19,500 AED, which is 23% higher than the compensation for those with a Bachelor’s Degree. This significant increase in salary is indicative of the added value that comes from having a higher educational attainment and the specialized knowledge that it provides.

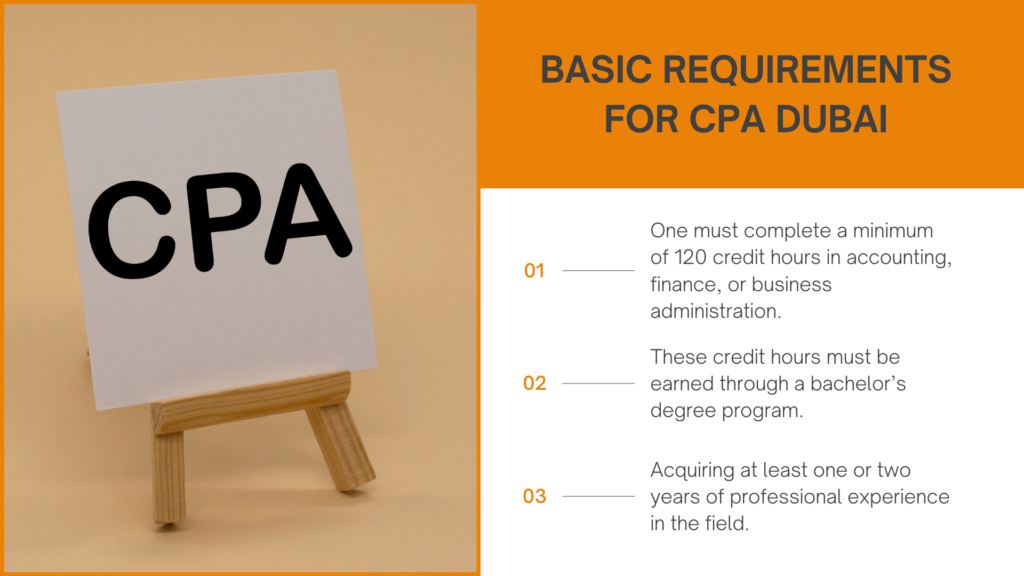

Basic Requirements for CPA Dubai

An Accountant salary in Dubai is quite impressive, however, in order to get there you need to work hard and one of the such course is CPA course. In order to be eligible for a career as a Certified Public Accountant (CPA), an individual must meet certain educational requirements. Specifically, they must complete a minimum of 120 credit hours in accounting, finance, or business administration.

These credit hours must be earned through a bachelor’s degree program, with coursework covering topics such as taxation, auditing, financial reporting, and accounting information systems. CPA candidates are then required to build on this foundation by accumulating an additional 30 credit hours and acquiring at least one or two years of professional experience in the field. After reaching these academic and professional milestones, individuals can take the Certified Public Accountant examinations and officially become CPAs.

Eligibility Criteria for CPA Dubai

In order to qualify for the Certified Public Accountant Examination and get high accountant salary in Dubai, a candidate must meet a stringent set of criteria. To be eligible, they must be at least 18 years of age and possess exemplary ethical character. Furthermore, candidates are required to have completed a bachelor’s or master’s degree from an accredited college or university that specializes in accounting-related studies. Additionally, all applicants must provide their valid Social Security number as part of the application process.

CPA Dubai Certification is a highly sought-after qualification that provides recognition for professionals in areas such as bookkeeping, corporate strategy, auditing and forensic accounting. Becoming certified provides numerous job opportunities – especially when it comes to positions abroad – and is an invaluable asset that will greatly increase one’s employability in the international market. As such, obtaining this certification is an important step for any aspiring accountant looking to further their career.

How to Apply for the CPA Dubai Test?

To become a Certified Public Accountant and earn high accountant salary in Dubai, you must first make sure that you meet all of the qualifications required. This includes gathering all of the necessary paperwork and documents to submit to your state board. Once that’s done, you’ll need to get your application ready for the CPA Exam, along with any associated fees. Once your application is submitted, you will then receive an Authorization to Test (ATT) from the board granting you permission to take the exam. After that, you should be sent a Notice to Schedule (NTS), which will provide details about how to book an appointment with Prometric – a company responsible for administering standardized tests.

It’s important for aspiring CPAs to make sure they are well-prepared in order to pass the CPA Exam on their first attempt, as this can save time and effort in the long run!

Certified Public Accountants (CPAs) based in Dubai are one of the most sought-after professionals in the Gulf Cooperation Council (GCC) countries and beyond. With its international recognition, CPAs have the opportunity to be employed anywhere in the world, often earning 30–40% more than their non-CPA counterparts. This makes CPA Dubai an incredibly attractive profession, as it provides a high level of job security and financial stability. Furthermore, CPAs are highly regarded for their expertise in financial management and business analysis, meaning they can often command higher salaries due to their knowledge and experience.

About CPA Dubai Certification

A Certified Public Accountant (CPA) is a distinguished designation offered by the American Institute of Certified Public Accountants (AICPA). This classification is widely recognized as the gold standard in accounting and requires individuals to pass the Uniform CPA Exam and fulfill specific educational and professional experience requirements. As a result of this rigorous certification process, CPAs are held to a higher level of accountability and trustworthiness in comparison to other financial advisors.

The CPA title carries a reputation of expertise, reliability, and professionalism in the business world. All CPAs are accountants, but not all accountants hold the CPA designation. Individuals and organizations alike turn to CPAs as their trusted financial advisors, who have the knowledge and experience necessary to help them achieve their financial objectives with confidence.

Significance of CPA Certification in 2023

Gaining a CPA license is an impressive feat that demonstrates a commitment to the profession, and often draws attention from employers looking for candidates suitable for management and leadership positions. A Certified Public Accountant license is also a requirement for those who wish to take on more significant levels of authority and responsibility.

Achieving a CPA certification requires rigorous schooling, typically achieved through completing both a bachelor’s degree and master’s degree combined with extensive studying and preparation for the examination.

The increasing demand of CPAs across the job market is due to various factors, making it likely that this trend will continue in the near future. Accounting professionals who have acquired their CPA earn an average of 10 percent more than those without one, as well as having many more opportunities to progress in their careers.

Auditing is often thought of as a narrow and restricted field, but that couldn’t be further from the truth for certified professionals. CPAs serve in various capacities across all kinds of organizations, from non-profit organizations and economic sector companies to federal government agencies.

Certified Public Accountant are the one to get a high accountant salary in Dubai credentials are essential for those looking to get into Accounting & Finance fields. It can provide a rewarding career path for both fresh graduates and experienced professionals alike. They must offer comprehensive accounting and auditing solutions, adhere to professional standards, and uphold ethical business practices that provide credibility and reverence among other professions. To become State-licensed accountants, CPAs must undergo an intensive academic and practical training program.

This combination of technical, managerial, soft, and hard skills has enabled them to take on leadership roles within organizations such as Chief Financial Officers (CFOs), Chief Executive Officers (CEOs), Chief Sustainability Officers (CSOs), Financial Controllers, Analysts, as well as Agents of Change

The CPA Dubai certification is a highly sought-after qualification in the accounting field, opening doors to a wide range of bookkeeping career options. From guaranteeing services and conducting forensic audits to international bookkeeping, internal and external auditing, tax and financial planning, consulting services and forensic accounting, the possibilities are seemingly endless.

A survey conducted by IMA in 2019 revealed that accounting professionals with a certification from a professional body in the UAE were among the highest paid accountant salary in Dubai and in the Middle East region. Responses showed that professionals holding advanced degrees earned an average salary that was 96 per cent higher than those with just baccalaureate degrees, while those in top management positions earned 88 per cent more than their counterparts in senior management roles. This demonstrates how having a CPA Dubai certification can significantly boost earning potential within the industry.

List of qualifications important for an Accountant In Dubai

Institute of Chartered Accountants of India (ICAI)

Pursuing a Chartered Accountant qualification might appear to be an arduous and lengthy process, but it can provide a substantial and lasting benefit to your career if you are based in the UAE. ICAI has several branches in the UAE, which enables their qualified members to practice in the country with ease. Moreover, the more pertinent experience you possess, the more your remuneration and growth potential will increase. This can open up many exciting prospects for you in the field of accounting.

Certified Management Accountant (CMA)

The Certified Management Accountant (CMA) designation is highly sought after by accounting professionals in the United States, as it provides an opportunity to advance their careers to the next level with this certification the accountant salary in Dubai increases amazingly. The CMA program is tailored to the needs of working professionals, allowing them to continue with their current jobs while they pursue their certification. This makes it a popular option for those who do not wish to interrupt their careers and take a break from work to pursue further education.

For Indian expatriates who obtain their CMA from outside India, membership in the Institute of Cost Accountants of India (ICAI), formerly known as ICWAI, can be applied for and obtained. This offers additional recognition of CMA qualifications within the Indian professional community.

Association of Chartered Certified Accountant

The ACCA (Association of Chartered Certified Accountants) is a globally recognized qualification originating in the United Kingdom and is increasingly popular amongst those seeking professional accounting qualifications. The ACCA is similar to its Indian counterpart in terms of the subjects it covers and difficulty levels, making it an attractive option for those looking to pursue a career in accountancy. Its professional scope and job prospects in the Middle East are also comparable to that of the Indian CA. An added benefit of opting for the ACCA qualification is that it provides more flexibility for part-time study, making it especially appealing for working professionals who are unable to commit to full-time studies..

Chartered Institute of Management Accountant

The Chartered Institute of Management Accountants (CIMA) is a renowned accreditation body based in the United Kingdom that offers a comprehensive accounting course focused on management and cost accounting. For those who would like to learn while they work, CIMA provides an online learning platform and self-study materials. This allows individuals to gain knowledge and develop their skills at their own pace.

Moreover, CIMA also provides comprehensive support and guidance throughout the duration of the course so that learners can achieve their desired outcomes, with the help of CIMA many individuals has reached in the category with the high paying accountant salary in Dubai, with its unique approach, CIMA has become one of the most sought-after certifications for aspiring management accountants.

Master of Business Administration (Finance)

In last few years, it has become common for employees in the accounting and finance industry to possess an MBA as a basic qualification. Mid-level executives and managers, who already have bachelor’s degrees in commerce, often pursue an MBA in order to gain an advantage over their peers.

When it comes to obtaining an MBA, there are numerous distance and correspondence courses available, but it is important to ensure that the degree is obtained from an accredited university. For those who are able to take a year off work, executive MBA programs from highly reputed universities provide a great opportunity; these intensive one-year courses are designed specifically with working professionals in mind.

Click on the link to learn about the Investment banking and Financial modeling.

Conclusion

In conclusion, the accountant salary in Dubai is quite impressive and lucrative. The average base salary for accountants in this city is estimated to be between AED 8,000 and AED 10,000 per month. This figure is significantly higher than the average salary across other cities in the United Arab Emirates, making it a popular choice for those looking to work overseas. Additionally, the cost of living in Dubai is relatively low compared to other international cities, meaning that the accountant salary in Dubai can give a high standard of living to the accountant while working in Dubai. Therefore, it’s no surprise that many finance professionals are drawn to Dubai for its attractive salaries and generous benefits packages.

Frequently Asked Questions (FAQs)

The average accountant salary in Dubai is AED 5,000 per month. The average accountant salary in Dubai with additional cash compensation is AED 6,500, with a range from AED 750 – AED 30,000.

A CA or an accountant salary in Dubai are as follows:

Freelancer Chartered Accountant salaries – AED 16,000/month

Dulsco Dubai Chartered Accountant salaries -AED 12,000/month

The Junior accountant salary in Dubai is AED 4,500.

A fresher accountant salary in Dubai is AED 4,702 per month.

Complete your CA course first, and then come here. There are enough good opportunities for semi-qualified CAs in Dubai and UAE. But the opportunities for a qualified Chartered Accountant are far far better. This is my perspective, you can still come here and get good opportunities as a semi-qualified CA.

The Average accountant salary in Dubai for an Indian is AED 19,750.

The top-paying industries for accountants include finance and insurance, management of companies and enterprises, tax preparation, and the government.