Introduction

The efficiency of people must be extended towards the right outlook to ensure growth and development of any organization. And, who oversees the people who make the organization? The Human Resources Department. The other resources cannot be operated effectively without human resources. The actual health of the organization is demonstrated by the variables of human behavior, like skill, motivation, group loyalty, and capacity for effective communication, interaction and decision making.

The success of an organization is based on how best the scarce physical or inanimate resources (namely, machines, materials, money, etc.) are utilized by the human resources. The effective and efficient utilization of these resources is largely based on the caliber, quality, skills, character and perception of the people, that is, the human resources performing with it.

The term Human resource at macro level may be defined as the amalgamation of all the characteristics possessed by all the people such as creative abilities, knowledge, skills, intuition, innovative thinking, imagination, and experience. The significance of human resources was not taken seriously by the top management of organizations for quite a long period.

Until now, unfortunately, the generally accepted system of accounting this principal asset, namely, the human resources has not been evolved. Hence, at this point, it becomes essential to pay due consideration on the proper development of such a principal resource of an organization. Here, we will discuss the conceptual framework of Human Resource Accounting.

What is Human Resource Accounting (HRA)?

Human resource accounting (HRA) may be defined as identification and accounting of expenses associated with employees of the organization and entails costs related to hiring, selection, recruitment, training, etc, that are currently unaccounted for in the traditional accounting practice. It serves as an extension of standard accounting principles.

It may also be referred to as the process of budgeting, assigning, and reporting the cost of human resources incurred in an organization, encompassing salaries and wages and training expenses. It is the activity of recognizing the cost invested for employees and in return analyzing their contribution to the organization towards its profitability.

HRA – The Concept

Human Resource Accounting (HRA) is a new and trending branch of accounting. The idea of HRA is based on the traditional concept that all expenses of human capital development is handled as a charge against the revenue of the period as it does not generate any physical asset. But nowadays, this concept has been modified and the cost incurred on any asset (as human resources) should be capitalized as it yields benefits measurable in monetary terms.

Human Resource Accounting is a system of accounting that keeps tabs on the financial and non-financial aspects of the employees of an organization. It is used to measure the strategic effectiveness of an organization’s human resources and to assess the performance of employees.

A Human Resource Accounting system should encompass metrics that appraise employee productivity, engagement, and training effectiveness. It should also be able to track employee turnover and absenteeism. The major purpose of the HRA system is to offer a reliable and accurate record of employee performance. It should also be employed to evaluate the effectiveness of employee training programs and assess employees’ performance.

The HR accounting process encompasses the following:

- Recognizing and comprehending the requirements of the organization and its employees

- Recognizing and developing the suitable human resources

- Executing effective recruitment, selection, training, development, and compensation programs

- Sustaining an accurate and up-to-date HR and payroll system

- To make sure that all employees are treated equally and fairly

Why do we need HRA?

The need for evaluation of human assets arose because of the increasing concern for human relations management in the industry.

Behavioral scientists bothered regarding organizations’ management noted the below mentioned reasons for HRA:

- The physical and financial resources cannot be effective operationally without people. However, no information regarding the human resources employed in an organization is made available under conventional accounting.

- Instead of being treated as investments, the expenses regarding the human organization are levied to current revenue, to be decreased with time, having the result that the magnitude of net income is significantly misrepresented. Comparing the assessment of firm and inter-firm gets difficult owing to this.

- The profitability and productivity of a firm is based hugely on the human assets’ contribution. Owing to the differences in human assets, two firms possessing identical physical assets and operating in the same market may get varied returns. The total valuation of the firm becomes difficult to comprehend if the value of human assets is not considered.

- The essential act of management on human assets cannot be discerned if the value of human resources is not duly disclosed in the balance sheet and profit and loss account.

- Under conventional accounting, spending towards recruitment, training, etc. are taken to be as expenses and written off against revenue. All expenses towards human resources are to be taken as investments, since the benefits are accumulated over time.

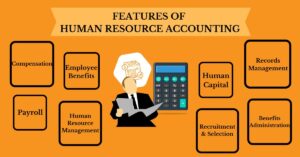

Features of Human Resource Accounting

There are certain features of the HRA that have been listed below:

Human Resource Management

It encompasses almost everything from hiring & release to training & development.

Employee Benefits

This involves things like health insurance and retirals.

Payroll

This comprises things like employee overtime costs, payroll taxes, and other expenses towards payroll and compensation processes.

Compensation

Stuff such as stock options, salary, bonuses, and other kinds of payment that employees receive are involved.

Human Capital

This includes stuff such as turnover rates, work hours, absenteeism, etc.

Records Management

This includes keeping track records, keeping tabs on equipment usage, etc.

Benefits Administration

This encompasses keeping track of benefits offered by employers, such as paid time off or vacation days.

Recruitment & Selection

This includes screening job applicants to suit the organization’s culture, in addition to hiring new employees.

Objectives of Human Resource Accounting

The objective of Human Resource Accounting is merely not

the identification of the value of all resources utilized by the organization, but it also encompasses the management of human resources which will lead to the enhancement of the quantity and quality of products and services.

The objectives of HRA are laid down to provide reliable and accurate information that can be used to make learned decisions about personnel, training, compensation, and other HR related matters.

Human Resource Accounting objectives can be as follows:

To help in knowing the cost and value of employees

The primary aim of the process is to identify the cost and value of human resources in an organization. It will assist in knowing the consequences of human resource expenses and what returns they deliver to the company.

To monitor the use of Human Resources

Human resource accounting aids a company in monitoring the value of each and every employee over a period of time. It also assists in the best utilization of the workforce available. Another objective is to help in justifying the expenses of hiring and training the employees.

To record employees as assets

This work aids the company in recording human resources as an asset in the company’s books. It assists the company in considering employees as its top most assets. The quality of work of the employees have been recorded through the years.

To evaluate the performance of the employees

The HRA system assists the administration of any kind of organization to assess the employees depending on their performance and their criteria and provide them with appropriate incentives.

Methods of Human Resource Accounting

While experts have presented a variety of models for this process, the two primary methods used are cost-based and value-based models.

Cost-Based Models

Historical Cost Model

This human resource accounting model is quite similar to the process companies use to evaluate their physical assets. In this model, the expenses incurred for employees are assessed against their expected association with the company. These expenses involve recruitment, hiring, training and development of the employee. Like this, the expenses incurred can be adjusted against the earnings over the same time frame. When an employee leaves the company before the expected association time is over, his value becomes low.

Replacement Cost Model

Companies employing this method of human resource accounting determine the cost of replacing an employee. The cost incurred in hiring a new recruit to replace the ex-employee is considered when a person leaves the company. This seems more realistic as the cost is assessed against the current financial status of the company. However, the one limitation of this model is that no two persons can be considered identical.

Opportunity Cost Model

In this model, the value of the employee is determined as the opportunity to employ the same person for another job. It occurs when the company relocates the same employee from one department to another. The value upsurges when the employee is in demand across different business units of the same firm. But the ideological bidding wars that might be raising or lowering a person’s value is the limitation of this human resource accounting model.

Value-Based Models

Future Earnings Value Model / Lev and Schwartz Model

This model works with the value of employees depending on their future earnings. However, this model depends on an unknown future and may not be able to present the appropriate picture. An employee might leave the organization even before the age of retirement. There are also chances that the job role of an employee might change in times ahead. Over the years, even the performance of people might vary.

Reward Valuation Model / Flamholtz Model

This human resource accounting model is an upgrade over the future earnings value model. It takes the fact that workers can shift their roles over time into consideration. The major limitation of this model is that one cannot foresee the movement of employees across multiple departments and their job role modifications. Assigning a monetary value to various roles is accurate only sometimes. Moreover, this model considers only the individual and brushes aside the value addition of an individual when working in a group.

Valuation As A Group Model

This model takes into account the value of an individual when they are working in a group. The effect of the individual on the group is also considered. It is much easier and simpler to foretell the average attrition of employees in a group than to predict the lifespan of each employee in the organization. Here, companies try to extract an individual’s economic value from the performance of the group. But one of the aspects that this model did not take into account was that a particular individual could be very strong while the other participants of the group could be weak.

Importance of Human Resource Accounting

The 21st Century is considered to be the century of the Service Sector. The scope of expansion in the manufacturing sector is minimal while all major expansion scope seems to be in line for the service sector.

But are the accountants being able to appropriately value this service sector and record this on the Balance Sheet of the company?

The core assets for any organization operating in the manufacturing sector are its machinery and fixed assets. However, for a service sector organization, its core assets are its employees which are referred to as intangible assets. The value of employees, for a service sector organization, gains prominence as earnings depend on the per-employee per hour billing model and profitability is associated with the addition of value by the workforce.

The Human Resource Accounting concept was primarily initiated for the service sector and has now started obtaining so much relevance that now companies in all sectors have employed HR Accounting and these reports are given importance when making any company analysis.

There are some other key points that increases the importance of Human Resource Accounting which are listed below:

- HRA helps the management to cost-effectively employ and utilize the human resources

- HRA aids the management to take decisions regarding transfers, VRS schemes, promotion, demotion, and retrenchment

- HRA offers a basis for planning about human resources

- HRA assists in recognizing beneficial employees and their associated cost and benefits

- HRA helps in formulating budgets or forecasts

- HRA aids the management to direct employees towards performance improvement

Benefits of Human Resource Accounting

Human Resource Accounting is referred to as a process that aids organizations in managing their human resources. There are many benefits or advantages of employing HR accounting software that are listed below:

Helps in Calculating ROI

Human Resource Accounting is referred to as an accounting system that identifies the cos

t incurred on an organization’s personnel. Once the investment is worked out, an organization can easily determine the exact ROI by calculating the earnings made by the organization. This will help to monitor how much the company should be spending on the personnel to achieve optimum ROI.

Helps in Inspiring Employees

Employees get motivated to improve their work and enhance their skills once they get familiar with their real value in the eyes of the organization’s human resource accounting system. The amount incurred for them will encourage them to boost the output in accordance with the organization’s financial investment.

Assists in Boosting Process of Choice Making

Human Resource Accounting serves as a center to receive information on the original value of individuals operating in the organization. This information aids the administration in making appropriate choices related to the organizational concerns.

Helps in Indicating Health of the Organization

Human Resource Accounting works as an indication of the well-being of any kind of organization. The amount of money invested on the personnel of any organization helps in measuring the amount of revenue that might be procured in the future.

Assists in Determining the Requirement of Recruitment

Human Resource Accounting reports on the modifications in procuring returns as well as how much expenditure is mandatory for the workforce of the organization. If there are high earnings, then demand for hiring new employees increases, while no more employment occurs if no earnings are procured. These decisions depend on the information provided by the HRA.

Helps in Ascertaining Unfavorable Results of the Programs

Additionally, the HRA system helps in demonstrating the negative effects of multiple programs running in the organization.

Facilitates Organizing and Executing HR Plans

HR policies of an organization involve plans related to human resources activities such as training, transfer, promotion, demotion, etc. It is vital to appropriately organize and implement these plans for the smooth functioning of every organization. This characteristic is controlled by an organization’s Human Resource Accounting system.

Limitations in Implementing HRA

Due to certain difficulties, HRA has not yet gained any momentum in India. The limitations of HRA has been mentioned below:

Incorrect Assumption

Human resource accounting is implemented to perform on the basis of assumption that the employee is going to be associated with the organization till the person turns retirement age or dies. This is purely hypothetical because employees are likely to shift from one company to another, even within a short span.

Dehumanizes Workforce

HRA can cause disparity among employees. Individuals who are valued higher by the organization may feel superior to those who receive low values. It can lead to jealousy among employees. It is even possible that it will result in low productivity and demoralization among the workforce. Employees can also get manipulated depending on the values they receive.

No Clear Guidelines

Clear guidelines are required to differentiate between the cost incurred and value of an employee. The current system of evaluating the employees in an organization is not perfect. It is not feasible to evaluate a human being like any other asset. With such indistinct guidelines, it is incorrect to assign high value to some individuals while others are valued lower. Moreover, the employees might leave the firm at any time, so the method of valuation will stand wrong. This renders the human resource accounting process inaccurate.

Disputed Measurement Methods

Another profound issue is the denial on the part of the accounting and finance department about the method employed for assessing employees. There are numerous methods of evaluation, and there seems to be no agreement on which one to use. This itself renders the process inaccurate. It is also not stated how they must be assigned a value and recorded into the balance sheets. All these hitches further complicate the process of human resource accounting.

Backlash From Trade Unions

A major complication in India is the active presence of trade unions. And, be it any kind of organization, require their approval for implementing any new system related to manpower. These unions may not give their consent to the method of differently valuing each employee of the same company. This can result in issues with the labor unions and lead to disruption of work in the company.

Despite the above challenges and limitations, numerous companies are contemplating to implement the system most effectively. It empowers companies to utilize manpower more profitably and effectively.

Conclusion – HRA – The Way to Success

Human Resource is the most beneficial asset for any organization. The organization will appropriately operate and will be able to function in the long run due to its efficient human resources. Hence, the accounting of human resources is vital. HRA is dependent on certain assumptions; thus proper valuation is not practically feasible. Though, there are quite a few limitations of human resource accounting.

Every new system brings with it a lot of difficulties and challenges. However, if the company is going to benefit from implementing the process, human resource managers must find out ways to put this in place. It doesn’t just benefit the organizations, but employees can also greatly benefit from human resource accounting because it lets them know their value. This exercise also helps them receive the training that is necessary to help them be more productive at work. It also leads to changes in the policies of companies about employees.

Frequently Asked Questions

1. What is meant by human resource accounting?

Human Resource Accounting (HRA) is referred to as the process of recognizing and recording investments incurred in any organization’s human resources that are currently unaccounted for in the traditional accounting practice.

2. What is the role of human resource accounting?

The role of Human Resource Accounting is to measure the cost and value of individual employees to the organization. It involves assessing costs incurred by any organization to recruit, select, hire, train and develop employees and analyze their economic value to the organization.

3. What are the types of human resource accounting?

There are 5 types or models of Human Resource Accounting, namely, Lev and Schwartz Model, Eric Flamholtz Model, Morse Model, Linkert Model and last but not the least, Organ’s Model.

4. What is human resource accounting and its benefits?

Human resource accounting can be defined as the process of identifying expenses related to employees of any organization, comprising those for recruiting and training. Other costs include selection and hiring expenses.

The benefits of Human Resource Accounting are as follows:

- HRA helps in improving managerial decisions

- It assists the management to employ the best methods of wages, salary, and overtime administration

- The methods of Human Resource Accounting present the original value of the human resource and their contribution

- Human Resource Accounting aids in efficient and proper utilization of personnel resources

- With the implementation of Human Resource Accounting, productivity can be enhanced

5. What are the 7 types of human resources?

The seven HR basics include the following:

- Recruitment & Selection

- Performance Management

- Training & Development

- Succession Planning

- Compensation and Benefits

- Human Resources Information Systems

- HR Data and Analytics

All these 7 basic HR functions and its expenses are accounted for under Human Resource Accounting system.